Last night on the Belgian television: André Bergen, CEO of KBC. He tried to convince us that the 0,5% extra that Rabobank, Deutsche Bank end Keytrade Bank give on their savings accounts is not a real differentiator. The man has a point of course. On amounts smaller than 5.000 EU that 0,5% doesn’t compensate the hassle of opening and managing an extra account. And when you have more than 5.000 EUto save, you must be somewhat retarted to use a "spaarboekske" (BR: poupança) as a savings instrument.

André Bergen points out that the network of agencies is KBC’s real differentiator. I personally go at most 6 times per year to my ING agency, even though I have more than 12 private and company accounts I manage at ING. The “local touch” of a bank agency has disappeared; completely.  Going to a physical agency has become a hassle, for everyone. Last week I saw that ING deducted 93 EU bank costs for 2008 on a startup company I founded in 2007. They however credited it back into the account of the company the day after with the message ‘new startup company pays no bank costs the first 2 years’. However, I have another startup company at ING. Also a BVBA which was also started in 2007. On that second company the sum of 93 EU was not credited back into the acount. I hate banks which are inconsistent. I call my agency to clarify the ‘different treatment’ on the two companies. The local ING agency in Gent couldn’t give an answer and had to call ‘Brussels’. I could as well have send a message via the online application and cut out the local agency. And this is exactly what ING wants to do: cut down on their agencies and invest in online features and convenience. This in sharp contrast to Fortis who will be further expanding its real world 'physical layer'. I can already feel the difference, in my local agency agency I can only do 'money transactions' at the counter in the morning from September 2007 on. Well, ING, given your strategic dimension I have some questions for you. I do a lot of banking, in a lot of countries. Most of it in supposedly ‘third world countries’ like Brazil and South Africa. Now, let me tell you that (online) banking in those countries is way more sophisticated than what ING (and most Belgian banks) offer me in ‘cutting edge Belgium’. Let me take some features from one of my South African banks (ABSA Bank) I truly miss in Belgium:

Going to a physical agency has become a hassle, for everyone. Last week I saw that ING deducted 93 EU bank costs for 2008 on a startup company I founded in 2007. They however credited it back into the account of the company the day after with the message ‘new startup company pays no bank costs the first 2 years’. However, I have another startup company at ING. Also a BVBA which was also started in 2007. On that second company the sum of 93 EU was not credited back into the acount. I hate banks which are inconsistent. I call my agency to clarify the ‘different treatment’ on the two companies. The local ING agency in Gent couldn’t give an answer and had to call ‘Brussels’. I could as well have send a message via the online application and cut out the local agency. And this is exactly what ING wants to do: cut down on their agencies and invest in online features and convenience. This in sharp contrast to Fortis who will be further expanding its real world 'physical layer'. I can already feel the difference, in my local agency agency I can only do 'money transactions' at the counter in the morning from September 2007 on. Well, ING, given your strategic dimension I have some questions for you. I do a lot of banking, in a lot of countries. Most of it in supposedly ‘third world countries’ like Brazil and South Africa. Now, let me tell you that (online) banking in those countries is way more sophisticated than what ING (and most Belgian banks) offer me in ‘cutting edge Belgium’. Let me take some features from one of my South African banks (ABSA Bank) I truly miss in Belgium:

1. As the administrator of my accounts on ABSA, I can enter my mobile number. On every account can set a limit. If I do an expense on that account exceeding that limit, I get a warning with the details of the payment exceeding the specificied amount. Via SMS on my mobile. Simple but extremely powerful. This works as well on my bank cards as on my credit cards. So when my wife goes shopping with the credit card, I can basically see which shops she is entering. Sheer convenience. Only not when she the SMS warning states the name of a lingerie shop; I tend to get distracted in that case.

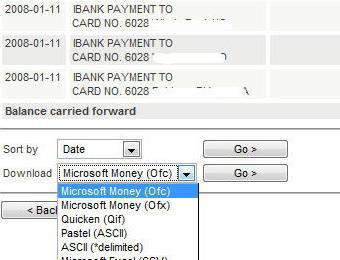

2. In the Homebank Plus Offline package I can only export to a messy txt file. I work a lot with Quicken. No problem in South Africa and Brazil, all my banks offer me export facilities to .ofc (MS Money) or .ofx (Quicken). These banks already offer this for years. How comes this is not possible at ING?

3. Cellphone banking. On my South African Telephone I can access my accounts via my Cellphone. Get my account balances, view statements, transfer funds, pay accounts,… Why is this not possible at ING?

4. Integration with online spending management tools. For my personal accounts I would love to use services like Spendview . Still no support for any of those services (countless Spendview-alikes are popping up).

5. Credit card statements. Can you believe that ING Belgium you cannot follow-up the payments of a corporate credit card online? They only have an online follow-up for private credit cards issued by ING Belgium. I already flagged this two years ago. They agreed it's 'somewhat unconvenient' and that they were going to remedy this. Still no solution since then. I mean: we want direct realtime follow-up of our credit card payments, export facilities and SMS warnings; on all of our ING credit cards, especially the corporate ones. This is the year 2008, not?

Why is ING not developing and launches these services? Why do runner-up banks like Keytrade leave this opportunity untouched? If they would only support 2 of the above features I would already switch away from ING.

Differentiate and innovate, Belgium! The third world is catching up on you!

Wow. It is hard to beleive that ING do not make these basic services available. The banking system in South Africa is very user friendly. Most of these systems (i.e. SMS messaging) was made available due to fraud. The positve about it is that there flowed other useful functions out of the banks way to stop the fraud. The negative about is that we do pay a lot for banking fees in South Africa for these services. The other negative is there is still exchange control in South Africa. Hopefully it would be abolished in the near future.

Posted 18 years ago