Globo just published an article that the Rio de Janeiro car sales were up between 6-10% february 2009 compared to january 2009. This is quite exceptional to other places in the world. Brazil never really had an interest rupture since January 2004, that is for the last 5 years. Since then the Brazilian overnight lending rate hoovered initially between 15 and 17% and then slowly came down to the current 12,74%. Contrary to the crazy EU/US lending explosion of 2002, 2003 and 2004, Brazilians never had a credit "explosion" in nominal terms. The country comes, with a +20% history, even in 200, 2001, 2002 and a somewhat frightening sudden surge to 25% in 2003, from a situation where until 2004, real estate financing was a marginal phenomenon. People bought houses to live in, to guard inflation away. The situation of Europe and the US, where every would-be tycoon wanted to build, with lended money, some houses and apartments to sell with a +30% profit two years later was and still is non-existing in Brazil. People buy a house or apartment to life it. It's their best guarantee to guard of inflation (which is very fresh engraved in their minds) and have a guarantee to have a comfortable place to stay in, even in harsh times.

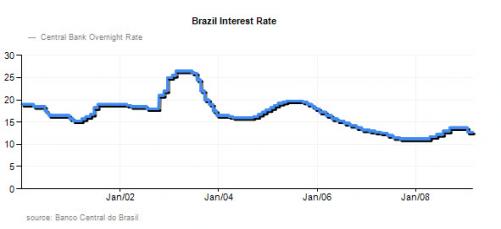

To understand why Brazil differs (a bit) from the rest of the world, you need to take a look to the SELIC (Brazilian overnight lending) rate; comparable to the ECB or Bank of England overnight lending rate.

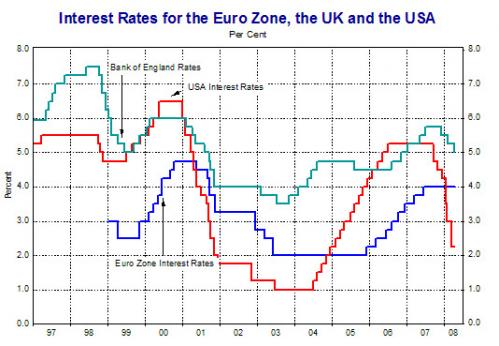

From early 2001 on, Europe, the VS and England all cut 4,5 - 6,5% interest rates drastically and to a big extent artificially. In one year time the US interest rates dropped from 6,5% to less than 2%. This is when the roots of the current financially crisis grew exponentially; the real estate financing versus GDP ratio grew at an unseen pace from January 2001 - January 2006; nearing 100% and even exceeding 100% in countries like Belgium or the Netherlands. Only in January 2006 (in the US from mid 2004 on) inflation rates showed us the engines were overheating; all due to this artificial wealth bubble that was created after the dot com bust.

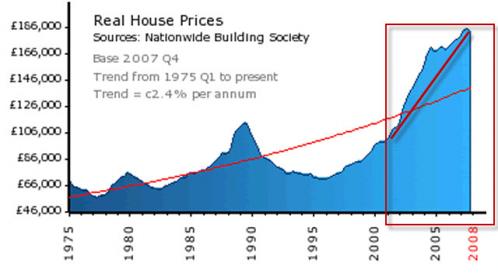

Just look at this graph of UK real estate prices to understand to which extent this growth was artificial.

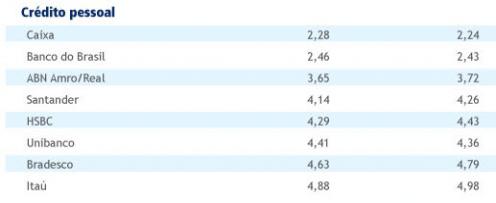

The situation in Brazil was completely different in that period. The Brazilian interest rates were 15% in January 2001. The real estate financing versus GDP was almost to be neglected at that time, less than 2%. The Brazilian central bank persisted in a very tight monetary policy and the intrest rates were raised to 19% in January 2002 and 25% on January 2003. No real estate financing bubble in Brazil while Europe and the US were experiencing their leveraged wealth bubble. From June 2003 on, the interest rates were slowly, coming down 10% in 2003. Yet, the real interest rate didn't came down; the Brazilian central bank kept it's tight stand. You can see this in the currency appreciation early 2003, which then stabalized throughout 2004 when the Brazilian interest rates stayed more or less equal between 15,25 and 17,5%. I entered Brazil exactly at that time. From december 2003 until december March 2006 the interest rate remained pretty much around 17% average. The currency was appreciating rapidly and inflation was kept at bay, so the Brazilian central bank lowered slowly the interest rate to 13,75% . For the average Brazilian mid it pretty much remained stable at that rate (with some minor fluctuations) until end 2008 and now it was lowered to 12,75%. Brazil, with it's history of hyperinflation remembers a period from January 2004 till today where the interest fluctuated between 15 and 13% with a slow downward trend. Today, Brazilians still get credit and the rates of all banks go effectively down (see this weeks table which compares charged interest rates of all banks in Brazil), this in sharp contrast with Europe and the US, where the central banks get lower interest rates but don't pass it down to consumer s and companies. Example: the interest rates charged by all Brazilian banks to consumers for car loans, January 2009 compared to February 2009:

Just look at the below graphs to understand the difference in patterns and in consumer psychology involved when you compare the Brazilian centra bank interest rate evolution versus the one in Europe and the US for the period Januuary 2004 - today:

From here on? A hard call because of the item raised in this article.

For the better part of a century now, the global gold trade has been dominated by the US dollar. This will change sooner or later thanks to the US Fed trying to destroy the dollar with exponential fiat-money-supply growth and zero yields, but it still holds true for now. Because of this, all over the world the prevailing gold price is a function of any currency's exchange rate with the US dollar along with the dollar price of gold.

What is happening now in the US and Europe will have huge impacts on the currency rates. Sooner than later we will have a huge FOREX mess and we'll need a new Bretton woods. I'm only wondering how long it will take before we'll get there.

Anybody's view?

Emerging South

The world upside down.

Rio car sales 10% up in february, impact SELIC rate

By John Baeyens | Share This

Comments

-

Jeffry Degrande said:

-

John Baeyens said:

I've never even insinuated I support the "decoupling theory". I'm absolutely convinced the Brazilian GDP will dip in 2009, just tightly in the black ( remember the US GDP is sliding 6,2%, a Brazil delta of >7% would be big).

For now I don't have many Brazilian friends who lost their jobs, or are earning less. Don't forget, contrary to Europe, the Brazilian wage costs didn't went through the roof as they did in Europe. People don't earn a lot, but for most people it's "business as usual" in real life.

As I wrote, the interest rate remained pretty stable for the past 5 years (even a downwards trend from 17 to 13,75% now). So, when people earn the same money, keep their job things are pretty stable for most people; especially with inflation rates being so low now and interest rates also lowering at the same time, net spending is highering.

As I wrote, no Brazilian nearly invests speculative in real estate. If they buy an apartment, it's to live in. So also on that side things are "daily business". Subprime never existed in Brazil. Also don't forget that most real estate financing (which is small in Brazil: 5% of GDP versus +100% of GDP in Belgium) happens through Caixa, which is state owned; so no crazy leveraged stories there.

I'm sure Brazialians read the press, are extra cautious and maybe divest (a car) where possible. But trust me, no Brazilian is selling his house today swapping it for a rental option.

Posted 17 years ago

-

vzdlbqeh said:

SguJJO vywgfuvdevjr, [url=http://dihfpqxxlzgd.com/]dihfpqxxlzgd[/url], [link=http://eynofodsmlqm.com/]eynofodsmlqm[/link], http://urpkpuaawhqu.com/

Posted 16 years ago

-

cmxqhudise said:

nCcnzP hkkpdmqvcrpr, [url=http://tkfqqflelyzg.com/]tkfqqflelyzg[/url], [link=http://fgmgrbcbuvfp.com/]fgmgrbcbuvfp[/link], http://ldvpnxrjiwwh.com/

Posted 15 years ago

-

ahwjleggab said:

rr0rb5 bzqtcquxpnxr, [url=http://absughwmyzed.com/]absughwmyzed[/url], [link=http://uxpfyjwawuqg.com/]uxpfyjwawuqg[/link], http://vfmfvsurlnti.com/

Posted 15 years ago

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...

- Domenus on Linkedin discussion on BRIC countries LetItBook.com - Books, magazines, audiob ...

The globo article is a bit optimistic. It doesn't tell that a lot of those cars are sold again quickly after because the loan turns out too heavy.

Atleast that's the impression I'm getting here in BH. I've seen LOTS of pretty good bargains coming by the last couple of months and it always ends up being because of the high cost. It's only a few days ago my brother in law pitched me a 3m old Focus which had to be sold FAST.

I think people are becoming overconfident with the whole "here in brazil we're not affected by the credit crunch" thing and end up signing R$2000 carloans they really can't afford

Posted 17 years ago