As was expected by most analysts, South Africa's GDP shrank in the second quarter of this year at an annualized rate of 3% over the first quarter as compared to the 6.4% rate seen in the first three months of the year. This is one of the steepest contractions seen worldwide. Especially agriculture was a serious disappointment, with a 17% drop in Q1.

The unemployment now raised to a total of 29,7% (28,4% in 2009). Also worrying is that retail sales decreased in June by an annual 6,7% following by a drop of 4,4% in May. The mix of people being worried about job security, high levels of household debt and still high inflation is is a deadly one. What is wost worrying is the inflation which remains extremely high.

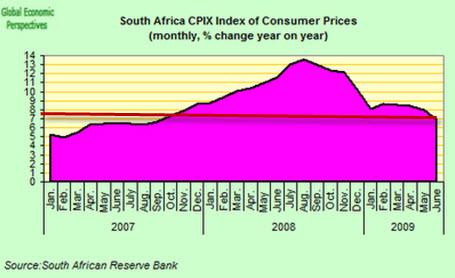

The year-on-year CPI inflation rate was 8. 1 per cent in January 2009. It then rose to 8.6 per cent in February before declining marginally to 8.5 per cent in March Inflation in the first quarter of the year was driven mainly by increases in food prices, alcoholic beverages, household maintenance and repair, electricity, and in financial services. Since that time the inflation rate has fallen back slightly - from 8.0 per cent in May 2009 to 6.9 per cent in June - but given the extended recession and the low levels of capacity utilization this rate is still noteworthy for its size. Electricity prices in South Africa went up by 28,6%. Inflation of 6,9% is a headache for the SA Central Bank. The bank already lowered its repurchase to 7 percent. Governor Tito Mboweni said in a televised statement after the monetary policy meeting that the decision to reduce rates had been a “very closely debated one”, and it seems unlikely that further rate cuts will follow rapidly. The South Africa rand has climbed 21% this year against the dollar. This is mainly due to the inflow of so called carry traders from Europe and the US. But is this impressive performance of the ZAR supported by the underlying macro fundamentals?

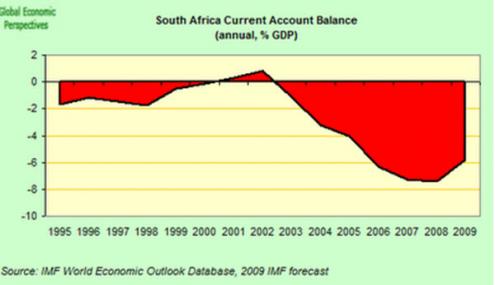

Negative growth, depressed confidence and steadily rising unemployment certainly do not make it look like it is. “We are deeply concerned about a permanent decline in productive capacity as factories close rather than simply reduce output,” Patel said to the South African Parliament, "Manufacturing output has been declining since mid-last year. It has now reached levels last seen some five years ago.” All of which naturally enough feeds directly through to the pretty substantial current account deficit.

The growing pressure on the fiscal side will be enormous. South Africa’s borrowing needs are likely to double the government’s projection according to estimates from JPMorgan Chase & Co. Government borrowing may surge to 183 billion rand (22,4 billion US$) in the 2009-10 fiscal year to cover spending, compared to the budgeted 90,37 billion budget. This would increase the budget deficit to 7,4% of GDP, compared to the forecasted 3,8%.

Read the full report here.