On April 30th, Standard & Poors nominated Brazil Investment grade. Not a word on that fundamental event in the Belgian press, even though it's far from being a fait divers. Remember my December investment tip? From 59,9 at that time to 69,2 today, that's a 15,5% gain in less than 6 months; not taking into account the currency win. Expect the Bovespa to further rally now that Brazil is investment grade and the Brazilian IPO market to remain exteremely active. This coverage on BBC explains the underlying economical fundaments.

I truly enjoyed reading that Brazil's president Lula now critizes the AAA rating of the US, the man has a point of course.

Back to Belgium now, for only 3 weeks, on June 1st we're flying back to Sao Paulo.

Emerging South

The world upside down.

-

May 9 2008

-

Apr 14 2008

Update April 18: Another oil field has been discovered outside the coast of Rio, which could contain 33 billion barrels (as a comparison, the whole US reserves total 21,8 billion barrels). This adds up the the below discoveries of 2007 and 2008 which already ranks Brazil on place before Venezuele when it comes to oil reserves.

I wrote before on the importance of the recent oil discoveries and the skills of Petrobras with regards to deepsea oil drilling. Tow days ago, the Washington post published an article which suggested that Brazil is to overtake Venezuela by 2013 with regards to oil production. To give youy some perspective to which level the recent discoveries are unique: Brazil didn't feature in the top12 countries with oil reserves less than a year ago.

And the news of discoveries doesn't stop. In November and December the Tupi & Jupiter massive fields were discovered and now Shell ad Galp discovered in zone BM-S-8 new fields and Repsol discovred new fields in zone BM-S-9. All fields are deeper than 5000m and require very costly platforms to drill them.

When i lived in Rio I was already impressed by the construction of the P-54 platform, which gas a capicity of 180.000 barrels of petrol a day and 6 million m3 of gas a day. It accomodates a crew of 160 persons, weights 73.000 ton and can dril 1400m deep.

With these new discoveries (between 5 and 30 109bbl), Brazil will pass to the 6th place in the ranking of countries with biggest reserves (just after the United Arab Emirates and just before Venezuela). Given the fact that Brazil doesn't consume a lot of petrol per capita (electricity comes suasi completely from hydroelectric, more than 5 million cars drive on ethanol and no need for central heating based on gas or petrol), this gives Brazil an enormous competitive edge.

Don't underestimate Brazil too much. I was already impressed reading this presentation from the Ministry of planning back in 2003, but with Lula's announcement to support a joint venture between Brazil and Mexico's state-run oil companies (Petrobras + Pemex), my eyes are all wide open. Mexico's crude oil output is in decline, which gives sense to Brazil's move.

-

Apr 14 2008

I wrote before on my fears of the food crisis ahead. Now that the IMF woke up, the news is allover. Even Belgian vegetables are becoming increasingly expensive. But that's nothing compared to the upcoming surge of rice prices of 30%. Today the news announced that Egypt is stopping export of its rice. But Egypt is a tiny producer of rice, with onlt 3800 '000 metric tonnes.

Do you know which country is the biggest non-Asian producer of rice? Guess. Yes, it's Brazil. With 7800 '000 metric tonnes, it's bigger than the US (5.900 '000 metric tonnes) and much bigger than the EU (1.792 '000 metric tonnes).

Oil, sugar, meat, rice, bananas, coffee, iron, ... it's hard to think of a commodity in which Brazil is not a net exporter.

Trust me, the impact of the food crisis is way bigger than that of the credit crisis, no, this is nt my apocalyptic warning. -

Apr 13 2008

They did it with Youtube, and now they plan to do it with wordpress.com. Leonardo Fontes has a good piece on the matter. Contrary to the Youtube block, which Youtube won (of course), there is no concrete event for the legal order from March to shut down Wordpress in Brasil.

My analysis is that this is simply a matter of protectionism. Wordpress is the 27th most visited domain in Brazil (worldwide Wordpress is the 49th most visited site), with more than 1,6 million Brazilian users active on Wordpress. Especially since the recent Wordpress upgrade, the service is becoming steamy hot amongst Brazilians. Meanwhile, all Brazilian media players offer Blog services. Wordpress has no office in Brazil. In sharp contrast to Google (and thus Youtube) which has a massive presence in Brazil.

The motivation for blocking Wordpress is thatr simple: Brazil doesn't like to have 1,6 million of its citizens speak free on a platform ran from the US with no legal entity in Brazil and not paying taxes or labor contribution in the country. It just takes one phone call form media Brazilian media boss (like UOL) to a Brazilian judge to motivate the judge for the closure of Wordpress.

My advice to wordpress: open an office in Sao Paulo, quick ! -

Apr 12 2008

Some people swear by the "crane factor" (counting the number of cranes you see when driving from the airport to your hotel and deriving the economical growth of a city/country from it). I have another theory: "the online t-shirt shop factor". The number of online t-shirt shops per capita tell you something of the entrepeneurshop and creativity of a country.

So, I decided to do the test for Brazil. At least once a week I'll do a review of an online Brazilian T-shirt show and buy one of their T-shirts, delivered to our Brazilian address, since most are targeted to the national market. If you'd like to order one yourself: we can always take it with us from Brazil, just drop us a mail what you'd want.

1. Camiseteria - www.camiseteria.com.br

Camiseteria is the brainchild of Fabio Seixas. The Brazilian threadless; I even think there is some official link between Camiseteria and Threadless, but Fabio has to enlighten me on that one. T-shirts are only sold on the site, not in (Brazilian) stores. The site is high-class, and developed by Brazilian Ebit. There's a nice social networking integration where you can meet people who already bought the Tee you are considering and see how the T-shirt fits on them. Delivery only in Brazil (you need a CEP nr).

I ordered: Welcome to Rio and Birdy. Price per T-shirt: 55 R$ (20,6 €).

RSS feed of the Camiseteria Blog and New Products.

-

Apr 9 2008

A friend at Intel Capital working in Belgium just forwarded me a newsletter of Olga de Meester working at the American Chamber of commerce in Belgium.

The text sounded:

"Did you know that Belgium was the world's leading per capita foreign investment recipient?"

Really? Numbers please? How much free float market capitalization is that? Brazil is now the 10th largest market in the world on the MCSI All Country World index, with a free float market capitalization of 509,1 billion US$, surpassing China.

"Did you know that over 900 US companies are active in Belgium?"

No. But that figure is completely insignificant. What turnover did they account for? And more importantly, how much did that turnover grow in 2007 and in Q1 2008?

"Did you know that Belgium has been elected as the second best country in Europe for foreign investments after Austria"?

No. Selected by whom? And based on which parameters? What I do know is that Belgium ranks third worst in the Forbes Tax Misery Index which was just published. More than beer and chocolate, tax misery (or rather, the lack of it) is what pleases companies in a country.

I could go on, but it's all a bit painful.

Some people think that I like bashing against Belgium whilst waving with my Brazilian flag. I don't think in black and white statements; Brazil will have its hard times the coming years and the country is far from perfect. That being said, the trend is obvious though: Belgium will even have a harder time. And Belgians just fail to understand how bad it will truly be.

I just read this excellent article the foreign ministers of Brazil, Russia, India and China meetingin Moscow in Spring 2008 to discuss issues of mutual interest in the international arena as also those relating to trade, development and financial system. The G7 countries are not invited. By 2050, I'll have my grandfathers age by then, the 4 BRIC countries will grow to outstrip the currently dominant members of the global economy, G-6, (US, Britain, France, Japan, Germany and Italy). But already much earlier will we feel the consequences of those giants breathing in our neck. And meanwhile, we do everything except preparing for our new, less comfortable position in this world. -

Apr 8 2008

Rock Werchter or Benicassim? Sigur Ros, Rosin Murphy come and Gnarls Barkley to both.

But Benicassim has:

Booka Shade

El Hijo (I'm a big fan of Abel Hernandez his new playgarden)

Facto Delafé y Las Flores Azules

In contrast to... Monza and Zita Swoon.

Too bad that Benicassim has been converted into a brick desert. We'll stick to a sunday afternoon chill at El Devino instead of those European mega-events. -

Apr 6 2008

Taking national flights in Brazil has changed a lot since 2001 when GOL came into the picture. Varig disappeared from the local market with GOL having taken it over and using the brand for serving 12 international destinations. If you plan your trip well in advance, Varig is currently the cheapest option to fly to Brazil from Belgium and France. You'll pay 633 EU for a return flight to Rio de Janeiro and and 640 to Sao Paulo, all taxes included. In 2007, BRA airlines also went into financial dark clouds, just shortly after having ordered 20 Embraer 195 planes.

Taking national flights in Brazil has changed a lot since 2001 when GOL came into the picture. Varig disappeared from the local market with GOL having taken it over and using the brand for serving 12 international destinations. If you plan your trip well in advance, Varig is currently the cheapest option to fly to Brazil from Belgium and France. You'll pay 633 EU for a return flight to Rio de Janeiro and and 640 to Sao Paulo, all taxes included. In 2007, BRA airlines also went into financial dark clouds, just shortly after having ordered 20 Embraer 195 planes.

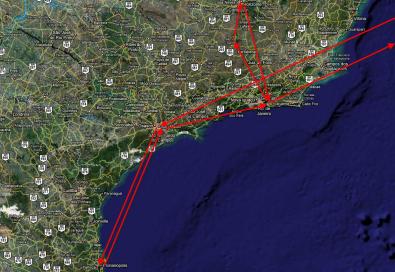

So basically Brazil now mainly has GOL and TAM serving the Brazilian national market. Add to that Oceanair and you'll have the complete spectrum. On our trip to Brazil in April we're flying into Sao Paulo via TAP (we tried all international carriers flying into Brazil and stick with TAP from now on) to Sao Paulo, then fly to Florianopolis, fly back to Sao Paulo, then Rio, then fly to Tiradentes, from Tiradentes we fly to Belo Horizonte, from Belo Horizonte to Rio and from Rio back to Brussels.

I must say that booking tickets in Brazil is a breeze. No, there are no engines to compare prices like Kayak. You just need to check the sites of TAM, GOL and Oceanair and make your own table. Example: below the table of direct flights we use from Florianopolis.

Things are going to change however. The founder of American JetBlue Airways is a Brazilian: David Neeleman. Last week he announced a new Brazilian airline to begin operating next year with three jets and eventually grow to a fleet of 76 planes flying nationwide. The new airline doesn't have a name yet. The name will be choosen by Brazilians visiting the website. Neeleman is making a very smart move:

1. There is definitely space in the booming national flights market.

2. Choosing Embraer 195 planes is smart. With the order of BRA not going through, Embraer had a problem. Besides, the Embraer 195 is a gem of a plane; I flew it from Sao Paulo to Panama on Copa.

3. The way Neeleman marketing tactics are playing on the Brazilian national pride is a smart move.

-

Mar 30 2008

In a speech to businessmen in Recife, Lula said British Prime Minister Gordon Brown had told him that Bush was bothered by some of the Brazilian leader's earlier comments on the situation.

Lula said he had then telephoned the U.S. leader.

"I said to Bush: 'The problem is this, my son. We (in Brazil) have gone 26 years without growth. Are you going to block us now? Resolve your crisis."'

Lula has attitude !

-

Mar 29 2008

On our trip in April we are visiting many enterprises and an early stage VC player in Brasil. The market space offers a unique window of opportunity, both in Brasil and Argentina. Lisandro bill made an excellent presentation summing up the state of the Argentinian market, most of his slides are also valid when it comes to Brasil. The Brasilian magazine 'Valor' has an excellent coverage on the Brazilian private equity market in a 2007 special issue. You can still read it online. I also strongly recommend reading "Como Fazer uma empresa dar certo em uma pais incerto" from Endeavor. The latter is very active in Brazil and a must to join when you are eyeing into the Brazilian private equity market.

Lately I have had many discussions with people on the comparison of Argentina versus Brazil when it comes to private equity opportunities. Yesterday, Vincent pointed me to this posting of Pablo Bertorello on Venture Capital in Argentina. Pablo has a point when he states that Argentina has to possibilities to emulate Israel when it comes to VC. Yet, I wouldn't write off Brasil too much. Only Brasil has much bigger barriers to enter. The language, the (business) culture, the business dynamics, the taxation,... It all depends how you prepare(d) for these barriers, they can be a challenge or an opportunity, depending on your skills and backgrounds. You have to talk to people like Marcos Gomes (21, CTO of Boo-box) and featured in Results.on -page 52- to understand the nature and potential of a new generation of Brasilian entrepeneurs.

As an introduction: Paulo Veras, CEO of Endeavor on Globo and a feature of one of their investee companies. When you are in Brasi, drop into a Spoletto restaurant, another investee company under the Endeavor wings.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...