Rio fashion week just ended last week. I didn’t pay much attention to the new 2008 winter collections; Carioca fashion is not my thing.

I prefer the Sao Paulo street-smart, hyper urban style.  The only irritating thing about Sao Paulo Fashion Week (FPSW) is the opening statement of Gilberto Gill. This year the Brazilian minister of culture preached: "Elegantes são os negros da Bahia, do Ilê-Ayê, que usam calças brancas comuns e camisetas sem mangas com a mesma graça de quem veste um estilista bacana”. Nice. But when asked why the government is not funding fashion projects and how the lack of fashion courses in public schools could be sorted, the man didn’t really have a convincing answer in his pocket. Worse, when informed about his personal fashion style, Gilberto answered in roaring words “that he believes in elegance and that elegance has nothing to do with money”. When the journalist than asked why Gilberto was wearing Prada, the man just smiled.

The only irritating thing about Sao Paulo Fashion Week (FPSW) is the opening statement of Gilberto Gill. This year the Brazilian minister of culture preached: "Elegantes são os negros da Bahia, do Ilê-Ayê, que usam calças brancas comuns e camisetas sem mangas com a mesma graça de quem veste um estilista bacana”. Nice. But when asked why the government is not funding fashion projects and how the lack of fashion courses in public schools could be sorted, the man didn’t really have a convincing answer in his pocket. Worse, when informed about his personal fashion style, Gilberto answered in roaring words “that he believes in elegance and that elegance has nothing to do with money”. When the journalist than asked why Gilberto was wearing Prada, the man just smiled.

Enough about him, I made my point I’m not a fan of his role as a minister of culture. We all know that fashion is not about politics or ethics. The models are as skinny and white as they have been before.

Emerging South

The world upside down.

-

Jan 20 2008

-

Jan 18 2008

Karel De Gucht, Belgian's minister of foreign affairs is traveling to East-Congo. He is flagging the 'sexual genocide' in East Congo and Belgium has to take the lead in doing something against it. The sexual genocide in East Congo. More than 70.000 women were raped in East Congo last year. Horrifying, true. But let's not fool ourselves, the war has hardly something to do with it.

Karel De Gucht, Belgian's minister of foreign affairs is traveling to East-Congo. He is flagging the 'sexual genocide' in East Congo and Belgium has to take the lead in doing something against it. The sexual genocide in East Congo. More than 70.000 women were raped in East Congo last year. Horrifying, true. But let's not fool ourselves, the war has hardly something to do with it.

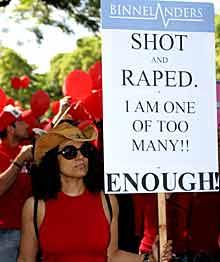

In South Africa, every 26 seconds a woman is raped; only 7% of these rapes lead to a conviction. Even Jacob Zuma, the highly-plausible-new-president-to-be is standing trial for rape.

Now, what is the thin red line in all of this: color. No, I'm not referring to the fact that more than 30% of the black South Africans are HIV+ -no, the 'please use a condom seems not to work when they grab you-; I'm referring to the simple reality that the statistics proof us that nearly all rapes in South Africa are being carried out by black men. Some South Africans are now angry that the press in South Africa writes more on white women being raped by black men than black women being raped by black men. They have a point when you know that 9 out of the 10 women raped in South Africa are black. But then again, if you know that one third of the children raped in South Africa are raped by their teacher, those statistics are not so surprising.

Why is it so undone to write in a factual way on the epidemiology of rape? Why is it political incorrect to plot the statistics in headlines; even when those facts are highly 'colored'? Every Brazilian woman is trained that the risk is far more allarming when you are followed by a coloured man then when being followed by a white man. Especially in summer -rape incidents are highly seasonal-.

Have fun on your trip to Congo, Karel. But your efforts will change nothing on the number of rape cases in Africa. -

Jan 15 2008

While things are starting to look grim in Europe, the situation in South Africa also gets somewhat cloudy. Remax in South Africa predicts that 17% of the South Africans could loose their house this year. In the US the mortgage crisis currently affects 2 million households. With an average of 3,6 Americans per household, this makes 7,2 million Americans and on a population of 200 million represents (only) 3,6% of all Americans affected.

And for the next two quarters, South African should brace itself for even harder months ahead. The consumer price index excluding rates on mortgage bonds was hovering at 7,9% year on year in November instead of between 3 and 6% as targeted by the SA Reserve Bank. At the end of this month the Reserve Bank will determine whether to impose another interest rate hike. It has already raised the interest rate four times in the past two yearts because inflation is not coming down. If raised, the interbanking prime rate would go beyond 15% !

However, for a variety of reasons I see light in the South African tunnel. Consumer debt is slowing since the introduction of the National Credit Act and the economic output is projected to keep growing at figures between 4 and 5% and the bulk of emplyment would remain relatively secure. With regards to growth and job security (South) Africa is much more resistant to the impact of this crisis in the long run than Europe is. The key question in both continents is how middle class will keep it's buying power in the coming decennium. -

Jan 9 2008

Brazil in the news last week:

> Mercopress: Brazilian economy at its best in 25 years

> Bloomberg: Brazil Bovespa's gain is Most in Four Years

> Bloomberg: Brazil's GDP-to-debt ratio falls to lowest since 1998

> Mercopress: Record investlments boost Brazilian growth to 5,2% in 2007

More worrying is that Brazil won't see a tax reform any time soon; something which is very much needed for making these announcements future proof. -

Jan 8 2008

Luc tipped me to watch the Dutch VPRO program “Tegenlicht” (click on the orange “bekijk uitzending")

He was my first boss at PING back in 1995. I have learned a great deal from him and still vividly enjoy reading his posts and talking to him. One of the things we differ on: Luc is a big fan of the US(A) and I would not be surprised if he’d announce tomorrow he's moving to Carifornia. I on the other hand feel at home in Brazil. I don't see Luc spending 3 months in Brazil -if I'm mistaken, Luc, we're leaving for 5 days with a group entrepeneurs end March-, just as I couldn’t stand living 3 months in the US. The reasons why I’ve always felt uncomfortable in the 'American society' are the same which are bringing the country to its knees. The VPRO video clearly illustrates the phenomenon. It’s a fake country, with fake people and fake figures. When the shit hits the fan, the masks fall. Brazilians on the other hand have flexed their muscles in a chaotic mix of cultures and economical tornado’s which makes the quote “Courage is grace under pressure” from Hemmingway far more appropriate on them than on the gringos.

Take for example the two main topics of discussion when people refer to the current economical context:

1. Will the US enter a recession?

2. What is inflation? Yes, what is inflation is a huge topic of discussion of I read through all the economical opinions these days. -

Jan 6 2008

It’s no secret I’ve never been a fan of the OLPC project of Negroponte. It’s a typical syndrome of people sending the missionaries used teabags.

It’s not about what people in developing countries NEED, it’s what they WANT. withNigeria, Brazil, Argentina and Thailand each wanting to buy 1 million pieces of these toys. Remember Northrop Grunman? They also had funky designers and engineers dressed in black developing the F-20's. They nearly didn't sell any. Why? The US Defense Department flew F15s and F16s and that’s what the third world wanted, not the lame F20. Nothing different for laptops. The people in developing nations who you pretend to be wanting to help are just like you and me, just as valuable, just as smart and just as deserving of nothing less than an Apple MacBook Pro as you and I are using. Start there and work back !

You’ve all read by now on Intel stepping out. No more Cosmopolitans.

The day after, the OLPC foundation started screaming and kicking and Negroponte went through the roof. Alas, no media hype can save them, Intel is the hero of the pack. They realized just in time that their own approach of a low cost computer for educational use is the right one. That approach is called the Classmate PC. A concept on which the hugely popular (amongst geeks these days) Asus eee PC is based on. In Belgian; Bart De Waele, the CEO of a Belgian renowned Web development company decided to switch completely to Cloud computing on the Asus eee PC. He even has a Blog on it. That’s people in the developing world deserve: a tool which is also used by Belgian top CEOs (and their kids).

-

Jan 4 2008

Brazil is kicking off 2008 with hypo press coverage:

>"Brazilian economy is finally coming of age"

> "Brazil's now hot commodity"

> "US equities shudder on economy fears. Emerging markets getting the love"

> "Brazil seeks formula for continued growth"

The real challenge of Brazil will be Lula's abilities to deal with Hillary Clinton. Lula managed to find Bush's G-spot, but Bill can testify that this endeavour is a far more complex matter in Hilary's case. Especially with Hillary's frigidity on global trade. -

Jan 3 2008

I start my daily routine listening over a cup of coffee to the daily news sessions of Miriam Leitão and Mauro Halfeld on CBN radio. Miriam analysis the macro economical context of Brasil, whereas Mauro focuses on the Brazilian stock market. Today Mauro talks about the Brasilian stock market in 2008. As I previously wrote, the Brazilian stock exchange market is no place for the weak-of-heart in 2008. A lot of juicy picks to make, but only if you have deep insights.

Mauro thinks especially the food sector in Brazil will score high. I fully agree with him. Not only for stock pickers, but also for entrepeneurs, the Brazilian food industry is full of opportunities. You pay 3 EU in a Belgian supermarket for juices made of Brazilian fruit pulp; the Acai juice in Delhaize even goes for 4,95 EU a liter. And at the same time you can buy that pulp (pure fruit, the nutritional values are actually better than the imported fres fruits you find in the Belgian supermarkets in winter) at Brasfrut for a fraction of that price. Not hard to put 1 and 1 together. Especially when you know that delicious fruits like Caju, Cacau, Siriguela, Tamarindo or Umbu are not known (yet) in Europe. But you can also explore chicken or ready-made food segments; not to mention the huge potential of the diary segment in Brasil.

I also strongly recommend reading Ricardo Pereira's 2008 insights on Dinheirama. -

Dec 29 2007

Belgian financial analysts have always been somewhat pathetic when it comes to making predictions. This year, things are no different.

Patrick Casselman breaks all records though. First he wants you to go for the Nikkei; he believes it will be the best performing index in 2008 ! And at the same time he wants you to diversify into the Bel20; he is convinced it will break through 5.000 points.

Let's say Patrick buys 50% into the Nikkei and 50% into the Bel20. Good luck. Me on the other hand, I'll buy for simplicity's sake 50% Petrobras shares and 50% shares of Companhia Vale do Rio Doce. Don't be mistaken, I think there are many more juicy picks to make, especially when you eye into ETFs. But I wanted to make a plain simple pick of two Brazilian companies which already made me a monster return in 2007: Petrobras went up from 41,38 to 119,16 and Rio Vale Doce went up from 13,53 to 38,32. Yes, that is a return of 284% if you bought 50% PBR and 50% RIO. You have to augment his yield with an extra 10% I made on the EU versus R$ exchange; the Real went 10% up against the strong-performing Euro.

I wonder what Patrick's December 2006 picks yielded in 2007.

And for stupidity's sake I'll hold on to those 2 Brazilian stocks. Sure, they won't yield 284% this year. But still I'm convinced that by end 2008 I'll make double the amount of money of compared to Patrick's Nikkei and Bel20 advice calls. I'd rather bet on Brasil than Belgium or Japan. -

Dec 27 2007

Since February 2006, the South African Rand is in freefal. This year, the currency has been constantly drifting downwards. I was in South Africa early December and I was stunned how cheap life in South Africa has become when you calculate back to Euros. A Big Mac Meal in Cape Town costs SAR 16,75 or 1,67 EU. Last year I would pay 2,5 EU for that same Big Mac Meal in Cape Town. According to this Big Mac index the Rand is seriously under valuated. And this is exactly the strange thing, the interest rate in South Africa is high, but still much lower than what it has been in the past; the growth rate is on track (4,8% GPD growth this year) and things are looking good for the ecoomy in 2008 (5,2% estimate for 2008). But still the rand falls.

While the Brazilian Real keeps scoring records; the slide of the South African Rand is continuing on a daily basis. Economists are clueless. They think the reason is a mix of more emotional factors: the Zuma factor, the politicians and their position with regards to AIDS, the situation in Zimbabwe. But none of these can justify the movement of the currency. The slide now has a momentum of its own. This is the time to enter the South African market or take a stake in a South African exporting business. The South African central bank is trying to dam panic and avoid inflation impacts by raising the interest rates -another reason to enter with money into South Africa-

My advice: wait until the SAR drops to 0,093 against the EU -very soon, a matter of weeks- and wire some money into South Africa and let it yield a healthy 11% on a Money Markets account until the currency takes up again by the end of 2008. Or better even: take a stake in a South African exporting business which is independent from importing machinery or raw materials.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...