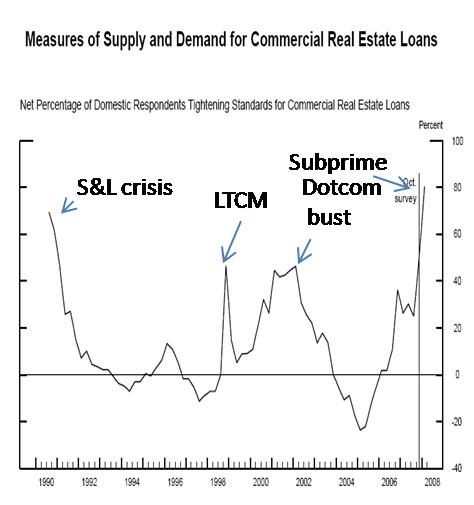

So you tought things are not that bad? Just a small hiccup in the economy? Wel, have a look to the Mountain-dew fresh results of the Federal Reserve senior loan survey. The current credit crunch which stiull hasn't reached it's momentum is worse than the Savings & Loans crisis in the early 90s, much worse than the crunch when the Long Term Management Capital Management blew up and far beyond the crunch of the dotcom bust. Paul Krugman made the below graph for you.

Looking pretty grim for a crisis which is just starting.

Emerging South

The world upside down.

-

Feb 9 2008

-

Feb 9 2008

You've probably all seen Laços by now, the movie by Flavia Lacerda and Adriana Falção, which won the Youtube short movie competition.

When I was reading about Mark Bowness new project 'Have you got the Nerve', I realized how wildly popular this would be in Brazil. If it was not for Mark being a tatooed promotor of Christian evangelism and Britain at the same time.

Who will be the one to launch a similar project which will unleash the true potential creativity of the Brazilian Youtube generation? -

Feb 8 2008

City Queens throws fine parties in Ghent. This time they go Rio de Janeiro. At least, that's what they pretend, the fact that none of the DJs has Brazilian roots is not exactly convincing. A shame, with the mass of excellent Brazilian-rooted DJs in Brussels, Paris and London ! We'll check it out with some native cariocas and if there's no Carioca Funk on the party, we'll officially tag the organisation as 'faux pas' for abusing the name of our city.

PS the video is a -rather tacky- trailer from the excellent Movie Tropa de Elite on which I wrote previously. The first track you hear on the party is called "Morro o Dendê" from MC Cidinho & MC Doca. One of my favorite Carioca Funk tracks. But not legally downloadable, the track is forbidden. If you want the movie or the track: shout.

-

Feb 7 2008

Robert Schiller was the American Economist who called the dotcom bubble 'serious' when all (Belgian) journalists were still interviewing the soon-to-be-millionaires. Which makes this interview absolutely a must to see.

... unpredictable consequences ...

... the decline of house prices will still be ongoing for more than a year ...

... unfolding other problems ...

... stagflation ...

... recession will take a much bigger tumble if we don't do something ...

... the support package of president Bush of 1% of the GDP is not enough ... -

Jan 28 2008

Apparently I'm not the only one who thinks Europe and especially Belgium is f***** when it comes to Energy. Below a quote from yesterdays coverage on MSNBC: "Russian energy deal adds to Europe fears":

Russia already supplies a quarter of Europe's natural gas and oil needs, and some Western leaders worry the growing dependence is giving the Kremlin a powerful geopolitical weapon. "I think you can now say that Russia has either won the war or is very close to winning the war" over gas supplies, said Chris Weafer, chief strategist at UralSib, a Russian investment bank. "Because the EU, which sought non-Russian import routes and non-Russian gas supplies, has failed to achieve anything."

Maybe we shouldstart installing solar powered traffic lights like they are doing in South Africa, where they know everything about power outages, or 'load shedding' like they call it over there.

If Brazil can manage it capacity planning of the(nearly 100%) hydro-power based electricity grid, they have a rosy future being a net exporter of petrol and soon gas, cf. the recently discovered Tupi and Jupiter fields in the Santos bassin and just outside Rio. -

Jan 27 2008

Robin Wouters flagged me this excellent Sketch on the Long Johns explaining the subprime crisis. I laughed, for a moment.

A few minutes later, Vincent Touquet send in this excellent article hon the real dimensions of the(subprime) crisis and the role of the Fed in it.

I think the concern that there is the potential for a much worse credit crisis than we are currently experiencing is what is driving the Fed. They are looking at the problem from the inside, and realize that they simply have to engineer a much steeper yield curve to allow the banks to make enough profits so that they might be able to grow their way out of the crisis over time. If I am wrong and the Fed was responding to the stock market, then we will likely not see a cut this next week. But if we get another 50-basis-point cut, as I think we will, then it means the Fed is responding to concerns about the credit crisis. And we will get another cut the next meeting and the next until we get down to 2% or below. Here is how I think the next few quarters are going to play out. Each new downgrade triggers more losses at financial institutions. You don't write down a bond insured by MBIA as AAA until there is actually a write-down. And then you do, and announce it at the end of the quarter. Along with the rest of the losses caused by new downgrades. We are going to see massive write-offs every quarter by the same financial institutions that have already written off $100 billion. We are only in the beginning innings. There are very serious suggestions that several extremely large banks (and not just in the US), of the "too big to be allowed to fail" size, technically have negative equity. With each announcement of a new massive write-off, we will see yet another large capital investment announced as well. And every time it happens, the market is going to be disappointed. And continuing disappointment is what keeps a bear market intact. Couple that with earnings disappointments from companies with exposure to consumer spending, and you have a recipe for a bear market that could linger for awhile. -

Jan 27 2008

Borrowing at short term and lending at long term rates; some Brazilians mogols became insanely rich doing that. Does anyone remember what the Plano Real was about?

Does anyone remember the 1999 'lessons learned' from Stanley Fischer of the IMF? Not quite apparently.

The Americans still believe that theFed can manage the volatility out of the economy by manipulating the money supply. An excellent post on the risks of putting this trust in the hands of the Fed.

Again hat-tip to Vincent for beaming this piece to me.

Ron Paul has it all figured out. I just fear his righteous analysis doesn't make him popular amongst Americans who prefer living in Disneyland instead of confronting their realities and start saving. -

Jan 24 2008

Luc quoted me on a previous piece where I wrote on inflation. I wrote that piece in a rather broad context. The current hiccup can maybe weather out for a few months, or even a year. But basically I believe we are heading for an drastic shift, where this time we are sitting on the wrong side. The problem with this crisis is that we can't truly grasp its fundaments. We are a generation which has been living our whole lives in an era of credit expansion with the dollar as the reserve. We had the ups and downs. You need to be a Brazilian to understand that there is a limit to the things you can buy.

What’s truly amazing about this financial hiccup is that every Belgian (and American) journalist keeps rambling that it’s ”just psychological”. Nothing is apparently wrong, we just have a minor bubble and we’re busy sorting it. I personally only have the economy of South Africa, Brazil and Belgium on my radar and though their dynamics are fundamentally different, there is one common thing: inflation has been rising for over a year now. Brazil has kept its interest rate steady for 5 months now, nothing changed. South African has been raising its interest rates to a prime rate of 14,5% and still it can’t tame inflation. Look on the world map: inflation is everywhere. Except in Japan.

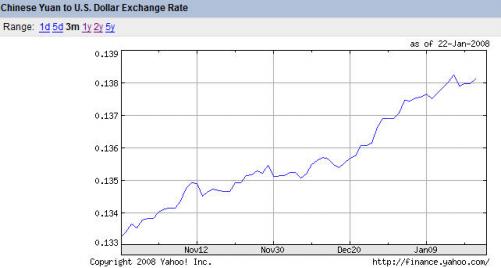

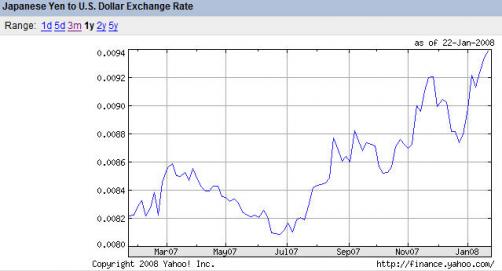

Read this interview with billionaire George Soros. He’ll explain you that the current crisis is not just a recession following a housing boom. It is the end of a 60-year period of credit expansion based on the dollar as the reserve worldwide currency. The US is psychotically trying to keep the order of things going. Meanwhile India, Brazil and Russia are looking to China for leadership. Oh, I forgot Japan. They try to get away from the trap, but they won’t succeed. Japan needs a weak yen to keep the US-imposed game going. But what now with the US interest drop. The dollar just became weaker than the yen. Now the Bank of Japan is even considering to drop their rate from 0,5% to 0% !!

Welcome to China’s game plan. Just look at the graphs of the Chinese Yuan and the Yen. They are bought rising faster and faster. And there is nothing they can do about it. O yes, they can and will drop their rate to 0%. Soon Trichet will also lower the interest rates in Europe. I sincerely hope he won’t, but he will. And all the banks in the world are dropping interest rates, except for China. Admitted, let’s add Brazil to that. Can you imagine the amount of wealth which will now flow into China because of its high real interest rates? Meanwhile the US is selling out, more bank deals where other nations buy up the financial system of the US. This is then broadcasted as the ‘good news’ in the press. Good news: the fed lowered its interest rates and the stock exchange responds positive, we hope. Meanwhile China raises its interest rates at the other side of the world. Americans, your government is asking you to send your savings to Brazil or China. It cuts the dollar so that the American engine can still continue for a while. Thank you for listening, Brazil surprised in December (again) with a surge in foreign cash. Meanwhile in the US and Europe, where we are debtor nations (contrary to Brazil now, yes, the world has changed a lot recently), we need loans at rates far below the rate of our inflation rates.

This crisis is not just a crisis; it’s the end of an era. The US and Japan are trying to weaken their currencies with low interest rates and encourage exports. It will work, for a while. Eventually the interest rates will drop to 1% and we will get an unseen depression. Because there is a limit to the things we can buy. If there is a house in Belgian for sale of 2 mio EU, I cannot buy it. Even with a loan of 1%, I cannot buy it. There is a limit to the things we can buy. This crisis will only be over once the US will have understood this. And the world will have dramatically shifted by that time. Meanwhile the US Fed keeps lowering its interest rate…. The reality is that the US is getting cheap money from China, Japan, Russia, the Arab oil countries and yes, even a little bit from Brazil. Why? Because those countries have huge FOREX reserves. They give the US (and Europe) cheap loans as long as we buy from them.

Until we come at the end. Because there is a limit to the things we can buy.

I add to this another dimension. Did you know that by 2030 the number of middle class people living in developing nations like China, India, Brazil and Russia will triple to 1,2 billion? Triple in 20 years time ! How are we gonna cope with that? Productivity gains? We, Belgium? In Belgium we even don't have the right geographical setting for renewable energy. Compare that to the sun, seashore and brutal water energy in Brazil. How f***** can we be? -

Jan 23 2008

Last night on the Belgian television: André Bergen, CEO of KBC. He tried to convince us that the 0,5% extra that Rabobank, Deutsche Bank end Keytrade Bank give on their savings accounts is not a real differentiator. The man has a point of course. On amounts smaller than 5.000 EU that 0,5% doesn’t compensate the hassle of opening and managing an extra account. And when you have more than 5.000 EUto save, you must be somewhat retarted to use a "spaarboekske" (BR: poupança) as a savings instrument.

André Bergen points out that the network of agencies is KBC’s real differentiator. I personally go at most 6 times per year to my ING agency, even though I have more than 12 private and company accounts I manage at ING. The “local touch” of a bank agency has disappeared; completely. Going to a physical agency has become a hassle, for everyone. Last week I saw that ING deducted 93 EU bank costs for 2008 on a startup company I founded in 2007. They however credited it back into the account of the company the day after with the message ‘new startup company pays no bank costs the first 2 years’. However, I have another startup company at ING. Also a BVBA which was also started in 2007. On that second company the sum of 93 EU was not credited back into the acount. I hate banks which are inconsistent. I call my agency to clarify the ‘different treatment’ on the two companies. The local ING agency in Gent couldn’t give an answer and had to call ‘Brussels’. I could as well have send a message via the online application and cut out the local agency. And this is exactly what ING wants to do: cut down on their agencies and invest in online features and convenience. This in sharp contrast to Fortis who will be further expanding its real world 'physical layer'. I can already feel the difference, in my local agency agency I can only do 'money transactions' at the counter in the morning from September 2007 on. Well, ING, given your strategic dimension I have some questions for you. I do a lot of banking, in a lot of countries. Most of it in supposedly ‘third world countries’ like Brazil and South Africa. Now, let me tell you that (online) banking in those countries is way more sophisticated than what ING (and most Belgian banks) offer me in ‘cutting edge Belgium’. Let me take some features from one of my South African banks (ABSA Bank) I truly miss in Belgium:

Going to a physical agency has become a hassle, for everyone. Last week I saw that ING deducted 93 EU bank costs for 2008 on a startup company I founded in 2007. They however credited it back into the account of the company the day after with the message ‘new startup company pays no bank costs the first 2 years’. However, I have another startup company at ING. Also a BVBA which was also started in 2007. On that second company the sum of 93 EU was not credited back into the acount. I hate banks which are inconsistent. I call my agency to clarify the ‘different treatment’ on the two companies. The local ING agency in Gent couldn’t give an answer and had to call ‘Brussels’. I could as well have send a message via the online application and cut out the local agency. And this is exactly what ING wants to do: cut down on their agencies and invest in online features and convenience. This in sharp contrast to Fortis who will be further expanding its real world 'physical layer'. I can already feel the difference, in my local agency agency I can only do 'money transactions' at the counter in the morning from September 2007 on. Well, ING, given your strategic dimension I have some questions for you. I do a lot of banking, in a lot of countries. Most of it in supposedly ‘third world countries’ like Brazil and South Africa. Now, let me tell you that (online) banking in those countries is way more sophisticated than what ING (and most Belgian banks) offer me in ‘cutting edge Belgium’. Let me take some features from one of my South African banks (ABSA Bank) I truly miss in Belgium:

1. As the administrator of my accounts on ABSA, I can enter my mobile number. On every account can set a limit. If I do an expense on that account exceeding that limit, I get a warning with the details of the payment exceeding the specificied amount. Via SMS on my mobile. Simple but extremely powerful. This works as well on my bank cards as on my credit cards. So when my wife goes shopping with the credit card, I can basically see which shops she is entering. Sheer convenience. Only not when she the SMS warning states the name of a lingerie shop; I tend to get distracted in that case.

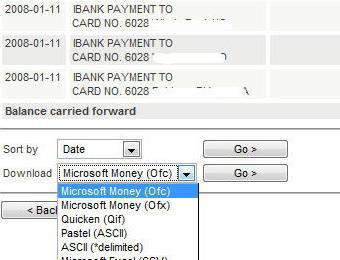

2. In the Homebank Plus Offline package I can only export to a messy txt file. I work a lot with Quicken. No problem in South Africa and Brazil, all my banks offer me export facilities to .ofc (MS Money) or .ofx (Quicken). These banks already offer this for years. How comes this is not possible at ING?

3. Cellphone banking. On my South African Telephone I can access my accounts via my Cellphone. Get my account balances, view statements, transfer funds, pay accounts,… Why is this not possible at ING?

4. Integration with online spending management tools. For my personal accounts I would love to use services like Spendview . Still no support for any of those services (countless Spendview-alikes are popping up).

5. Credit card statements. Can you believe that ING Belgium you cannot follow-up the payments of a corporate credit card online? They only have an online follow-up for private credit cards issued by ING Belgium. I already flagged this two years ago. They agreed it's 'somewhat unconvenient' and that they were going to remedy this. Still no solution since then. I mean: we want direct realtime follow-up of our credit card payments, export facilities and SMS warnings; on all of our ING credit cards, especially the corporate ones. This is the year 2008, not?

Why is ING not developing and launches these services? Why do runner-up banks like Keytrade leave this opportunity untouched? If they would only support 2 of the above features I would already switch away from ING.

Differentiate and innovate, Belgium! The third world is catching up on you! -

Jan 21 2008

Recent nog op het nieuws: hoe de “kleine” banken als Rabobank en Deutsche Bank massaal klanten aantrekken met hogere tarieven. En gelukkig dat we allemaal zijn met onze 4% (die overigens niet hoger kan wegens wettelijk maximum intrest op spaarboekje = 4%). Wat we allemaal vergeten is dat de inflatie in België nu 3,1% bedraagt en naar mijn inschatten nog (substantieel) verder zal stijgen in 2008.

De meeste mensen weten eigenlijk niet (precies) wat inflatie is; ik schreef hier reeds over. Getuige hiervan de discussie tussen Yves en Marc Huybrechts in de comments van deze post. Zoals Marc terecht meent is de enige ‘complete’ inflatie-meter in een economie de GDP-deflator. Dit is inderdaad iets wat men eigenlijk enkel ex-post kan berekenen op basis van de Nationale Rekeningen. Zoals Yves toelicht heeft inflatie invloed op intresten. Zij het met vertraging. Zeker wanneer de discrepantie tussen de geschatte inflatie, op basis van de Belgische korf voor het berekenen van de CPI en de GDP/BNP deflatie groot blijkt te zijn (wat in 2007 absoluut het geval was en in 2008 nog meer het geval zal zijn). Dit leidt inderdaad tot een herverdeling van schuldeisers naar schuldenaars. Helemaal leuk wordt het natuurlijk wanneer je schuldenaar bent in België om schuldeiser te worden in Brazilie. Concreet: wanneer ik in België geldt beleg op een spaarrekening krijg ik 4% intresten. Trek daarvan de (geschatte !) inflatie van af en ik hou 0,9% netto over. In Brazilië brengt een spaarboekje (poupança) me 7,75% op. De inflatie voor 2008 wordt op 4,29% geraamd en werd recentelijk naar beneden herzien. De Braziliaanse inflatie leunt overigens sterker aan bij de reeële GDP deflatie dan de Belgische. Ik hou dus 3,46% netto over; een veel eerlijkere netto spread. En de vraagt stelt zich of ik met de Braziliaanse inflatie rekening moet houden? Wat telt is de koersvergoeding BRL/EU wanneer ik in EU reken, of een verhouding 30% BRL en 70 EU (mijn uitgavenpatroon). In dat geval is de netto opbrengst 4,65%. Daar moet ik wel 15% van aftrekken (Braziliaanse CDI tax, in België betaal ik op de eerste 2.500 EU geen roerende voorheffing). Of 3,95% netto ‘real’ intrest. Doch, zonder Braziliaans paspoort krijg je geen Poupança, dus je kijkt naar een CDI fonds met kapitaalbescherming dat je 0,7% per maand kan garanderen. Bijvoorbeeld een combinatie van Legg Mason DI Special en UBS Pactual Mutual Credito.

Ondertussen raast de echte inflatie in België op ongeziene hoogten. De ECB die de interesten verder gaat optrekken? Neen, zij vinden dat er vooral geen loonstijgingen mogen komen. Nochtans zijn die loonsstijgingen na al die maanden knagende inflatie broodnodig, zeker nu de gas en electriciteitsrekening ook aan ons budget gaan knagen als waren het piranas. Maar neen, de ECB zegt dat we geen extra loon mogen krijgen. Dan zal de 'inflatie' binnen enkele maanden vanzelf overgaan. U las ook toch vorige week in alle kranten dat alle Belgische consumenten met nooit geziene kredieten zitten?

Dus: (1) de 'echte' inflatie is veel hoger dan diegene die in de Belgische CPI wordt berekend (2) de ECB komt niet monetair tussen, ze houdt de intrest artificieel laag (3) er komen geen loonsstijgingen om de inflatie bij te benen (4) alle Belgen gaan kredieten opnemen om hun koopkracht te bestendigen. Deze mix klinkt me zo herkenbaar in de oren?

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...