Since Emerging South and it's Linkedin Group started in 2007, we've seen serious traction in high-quality coverage of Emerging Markets. Traditional European media have missed the boat of providing in-depth economical analysis of Emerging Markets.

One of those not-to-miss sources is MyStockVoice of Paul Harper, who is also on Twitter. Juts check his last posting on Chinese officials getting nervous about the state of the US economy and his coverage on Brazil.

Emerging South

The world upside down.

-

Apr 18 2009

-

Apr 13 2009

Quote from Toronto Star this weekend:

"While China and India will remain the largest (emerging-economy markets), Airbus forecasts that some 30 additional emerging economies, including Argentina, Brazil, South Africa and Vietnam, with a combined population of almost three billion people, will grow increasingly prominent by 2026." -

Apr 9 2009

-

Mar 29 2009

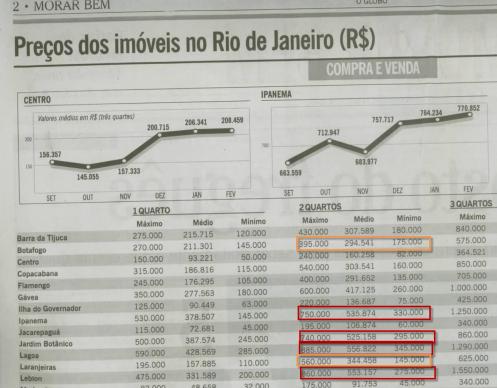

As promised last week: an update from the real estate market in Rio de Janeiro.

Until september Brazil was completely outside the current market crisis. It took even until Oktober to see a very slight impact on the real estate prices. In the center, the prices had a small 10% dip in price in October. In Ipanema the prices dropped 3,9% in November. From November on prices rose again. Actually, from September until end February prices rose 30,8% in Rio de Janeiro center and 16% in Ipanema. Consider than that inflation is around 5% y/y (2,5% 6 months) and you have your net appreciation.

A 2 bedroom apartment (in Rio a 2 bedroom apartment is max 85m2, you need a 3 bedroom apartment to get to 95-115 m2) comes at an average price of (dived by 3 to get the prices in Euros):

Ipanema: 750.000 R$

Leblon: 860.000 R$

Lagoa: 885.000 R$ (Lagoa topped Leblon and Ipanema, different from 2004)

Jardim Botanico: 740.000 R$

The cheaper areas in zona sul are Botafo and Laranjeiras. Amazingly the average prices in Laranjeiras also rose to 560.000 R$.

I could dedicate an entire blog on the real estate market of Rio de Janeiro, one of the most interesting (and most complex) ones in the world. Drop me a line for more insights.

Drop me a line for more insights. -

Mar 29 2009

When I came living in Brazil in 2003 the first big potential I notice was the country's ability to be self-sustaining.

Brazil has plenty of food (it's the second biggest food exporting country in the world), is self-sufficient in petrol, has 80% of it's electricity coming from renewable hydro-plants, has iron ores and exports steel, makes its own cars, is the biggest meat exporter in the world, exports clothes and shoes,...

It mainly is depending on natural gas (although that might change in the future) and machinery and electronics imports.

I know, the military tried that route in the 70/80s and failed, yet I believe that this crisis is so fundamental that increasing protectionism could be a good choice for Brazil in the long run. And I'm not alone, why else would Mandelons by screaming so loud to Brazil to never regard its frontiers as the boundary.

Yestedray George Soros warned that the UK might have to seek IMF rescue. Brazil still has the IMF rescue of the 90s fresh in its memory. This time they have nothing to do with the causes of this economical crisis and this time it's "the others" who are in trouble and having to seek IMF aid. Don't expect too much mercy and understanding of Brazil towards the "white people with the blue eyes".

This other article from Soros on the UK is also a must-read. -

Mar 25 2009

People asked me how the employment markt is fairing in Brazil. Below the most recent graphs from Globo.

It is crucial to understand two layers of duality here:

1. There is avery big dichotomy between the Northern and Southern States, the job losses of February are almost exclusively recorded in Northern States of Brazil (Amazonia, Rio Grande do Norte, Alagoas, Paraiba, Para). In Rio de Janeiro and Santa Catarina states respectively 5.480 and 5.647 people were contracted in February.

2. There is a big difference in industries. It is mainly the assembly sector and mining sectors which is slashing people. The services market has hired more than 57.000 people in February and also the construction industry had a net job increase in February.

Tomorrow some stats on the real estate market in Rio de Janeiro.

-

Mar 24 2009

An excellent extensive report on the matter has just been published by the Inter-American dialogue, a must-read.

-

Mar 22 2009

I previously wrote on David Neeleman, the former JetBlue CEO starting up the Brazilian carrier Azul.

When I came living in Brazil early 2004, GOL was a small startup carrier, it had not more than 20 connections within Brazil. Flying is hassle free in Brazil, especially when compared to flying within Europe or the US; not to mentio n taking connecting flights in Heathrow (terminal 5 !) or Miami. My advice: always avoid those two airports.

The small challenger of 2004 changed, today GOL has an integrated network of approximately 800 daily flights to 59 destinations in Brazil and South America, the most comprehensive route network in South America with a total fleet of 115 aircraft. Sure, also for GOL Q4 2008 was challenging, yet I don't think many aire carriers can match them in keeping their figures up. GOL's net revenue totalled 1.548.600.00 R$ in Q4 2008, which is 5,2% up from Q4 2007. The company transported 6,1 million passengers in Q4 2008.

However, with GOL buying VARIG, the Brazilian market again risked to be for 80% in hands of a duopoly (GOL and TAM); yes there are many other players like Oceanair, but those are no real threats to players like GOL and TAM.

Which is why it's good that Azul steps in the game.

Below you can find an interview with David Neeleman on the opportunity and challenge of starting an airline carrier in Brazil. He righly explains that the true market opportunity in Brazil is grabbing the 200 million people who never flew yet and are paying expensive tickets for using bus transport throughout the country. Even GOL itself is using campaigns to attract bus travelers to its planes.

We flew Azul for the first time and the service and comfort in the Embraer planes is just stunning (79cm leg space !).

I have an amazing respect for hard working people like David Neeleman opening the opportunity of emerging markets. As an example: here's the story of last Friday of how Neeleman is trying to exercise the rights to land on the much desired Santos-Dumont airport in the centre of Rio which was renovated under the wings of one Simone Mendonça. -

Mar 11 2009

South Africa is flooded by poor economic data. First, South Africa’s purchasing managers index plummeted to a record low of 39.2 points in February 2009.

Secondly, a disastrous month for the motor manufacturing industry as February new passenger vehicle sales plummet further. The industry is on the brink of collapse and is hoping for R10bn from government to keep it going.

And the thirdly – a disappointing January 2009 trade deficit has sent the rand into freefall against the Euro and dollar. This is in sharp contrast with Brazil posting a trade surplus in February.

This means inflation will go up again in South Africa, which will firther weaken the Rand. I have been warning for more than a year now how South Africa's trade deficit is a serious problem. Customs and Excise reported the January 2009 number at R17.380bn – the weakest on record – and a fair margin worse than the previous R14.7bn ‘low’ recorded in October 2007.

With this new inflationary pressure, you can expect that there will be no immediate further rate cuts in South Africa. The South African prime rate is still 14,00% !! Meanwhile in Brazil, the comparable SELIC rate which is at 12,75% will highly probable be dropped to 11,75% this week. More importantly is that in Brazil the spread charged by the banks is also going down; I'll write on this later this week.

-

Mar 9 2009

I'm sitting ina Brazilian airport catching up on the news of the last days. If I add up the below impressions I catched up, I see a thin read line; am I biased?

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...