Only yesterday did I publish this article stating my scepticism on South Africa; one of my arguments is the complete lack of private saving rate in South Africa; something where the government cannot easily act upon. Still South Africans believe they can spend themselves out of trouble and the economic prospects that finance minister Manuel Trevor announced last week are called "heroic" (an ephemism for 'naive').

And just today did I discover this new report which the IMF just published on South Africa, titled: "Why Isn’t South Africa Growing Faster? A Comparative Approach", 25 pages long and a must-read.

Bear with me for the conclusions:

Emerging South

The world upside down.

-

Mar 9 2009

-

Mar 7 2009

When I arrived in Brazil the first thing that stroke me is that all restaurants are jammed with people. True: Embraer (planes) and Rio Vale Doce (iron) dismissed people; but national consumption doesn't seem to be affected for now. I explained in a previous post the dynamics behind this.

A lot has been writte on Brazil last week; Karine Huet wrote a very balanced Brazil special feature in the Trends of March 5th, titled: "The B of the BRICS dances the Samba" and The Economist also dedicated an article on Brazil.

The arguments of the article in The Economist repeat what I have been saying for the last two years:

"The reasons for Brazil's improvement are largely to do with public-sector debt, which was once a weak point but has been brought down below 40% of GDP. Foreign-currency borrowings have mostly been exchanged for real-denominated ones, so slumps in the currency no longer hurt the government’s balance-sheet. Brazil has built up $200 billion of reserves to defend the real. Its current-account deficit is small. Most important, this crisis is not pushing up inflation—Brazil’s congenital weakness. That in turn has allowed the central bank to cut rates (making public debt cheaper to service). This is the first time Brazil has been able to run a counter-cyclical monetary policy.

Yet by comparison with Brazil’s recent past, and also with what other countries are experiencing, the economy is in fair shape. The IMF forecasts that only the developing countries in Asia (which are poorer than Brazil), Africa (ditto) and the Middle East will do better in 2009. Given Brazil’s previous tendency to go into cardiac arrest whenever economies elsewhere became stressed, this is impressive."

When looking at this chart of the economical status of Europe, with more than 13 European countries having a public debt versus GDP ratio of more than 40%, which is Brazil's public debt ration one can indeed only say the status of Brazil is indeed impressive. Belgian's public debt to GDP ratio is actually today more than twice as big as Brazil's.

Add to that Brazil's commercial balance was positive in February, the country exported 1,767billion US$ more than it imported, things surely look not as grim as one would expect in this worldwide downwards spiral. -

Feb 28 2009

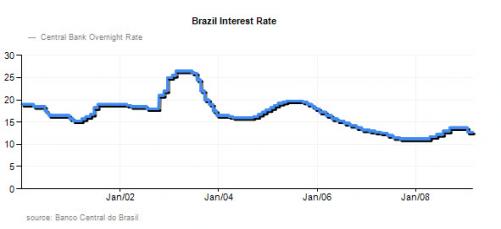

Globo just published an article that the Rio de Janeiro car sales were up between 6-10% february 2009 compared to january 2009. This is quite exceptional to other places in the world. Brazil never really had an interest rupture since January 2004, that is for the last 5 years. Since then the Brazilian overnight lending rate hoovered initially between 15 and 17% and then slowly came down to the current 12,74%. Contrary to the crazy EU/US lending explosion of 2002, 2003 and 2004, Brazilians never had a credit "explosion" in nominal terms. The country comes, with a +20% history, even in 200, 2001, 2002 and a somewhat frightening sudden surge to 25% in 2003, from a situation where until 2004, real estate financing was a marginal phenomenon. People bought houses to live in, to guard inflation away. The situation of Europe and the US, where every would-be tycoon wanted to build, with lended money, some houses and apartments to sell with a +30% profit two years later was and still is non-existing in Brazil. People buy a house or apartment to life it. It's their best guarantee to guard of inflation (which is very fresh engraved in their minds) and have a guarantee to have a comfortable place to stay in, even in harsh times.

To understand why Brazil differs (a bit) from the rest of the world, you need to take a look to the SELIC (Brazilian overnight lending) rate; comparable to the ECB or Bank of England overnight lending rate.

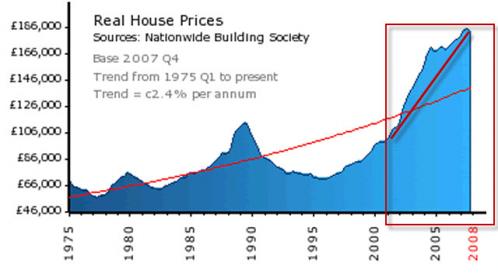

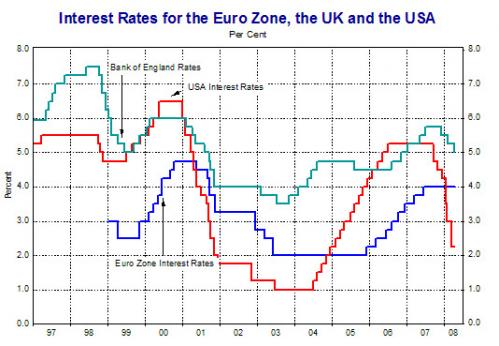

From early 2001 on, Europe, the VS and England all cut 4,5 - 6,5% interest rates drastically and to a big extent artificially. In one year time the US interest rates dropped from 6,5% to less than 2%. This is when the roots of the current financially crisis grew exponentially; the real estate financing versus GDP ratio grew at an unseen pace from January 2001 - January 2006; nearing 100% and even exceeding 100% in countries like Belgium or the Netherlands. Only in January 2006 (in the US from mid 2004 on) inflation rates showed us the engines were overheating; all due to this artificial wealth bubble that was created after the dot com bust.

Just look at this graph of UK real estate prices to understand to which extent this growth was artificial.

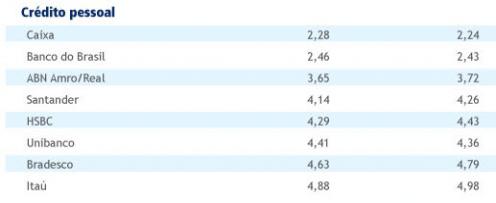

The situation in Brazil was completely different in that period. The Brazilian interest rates were 15% in January 2001. The real estate financing versus GDP was almost to be neglected at that time, less than 2%. The Brazilian central bank persisted in a very tight monetary policy and the intrest rates were raised to 19% in January 2002 and 25% on January 2003. No real estate financing bubble in Brazil while Europe and the US were experiencing their leveraged wealth bubble. From June 2003 on, the interest rates were slowly, coming down 10% in 2003. Yet, the real interest rate didn't came down; the Brazilian central bank kept it's tight stand. You can see this in the currency appreciation early 2003, which then stabalized throughout 2004 when the Brazilian interest rates stayed more or less equal between 15,25 and 17,5%. I entered Brazil exactly at that time. From december 2003 until december March 2006 the interest rate remained pretty much around 17% average. The currency was appreciating rapidly and inflation was kept at bay, so the Brazilian central bank lowered slowly the interest rate to 13,75% . For the average Brazilian mid it pretty much remained stable at that rate (with some minor fluctuations) until end 2008 and now it was lowered to 12,75%. Brazil, with it's history of hyperinflation remembers a period from January 2004 till today where the interest fluctuated between 15 and 13% with a slow downward trend. Today, Brazilians still get credit and the rates of all banks go effectively down (see this weeks table which compares charged interest rates of all banks in Brazil), this in sharp contrast with Europe and the US, where the central banks get lower interest rates but don't pass it down to consumer s and companies. Example: the interest rates charged by all Brazilian banks to consumers for car loans, January 2009 compared to February 2009:

Just look at the below graphs to understand the difference in patterns and in consumer psychology involved when you compare the Brazilian centra bank interest rate evolution versus the one in Europe and the US for the period Januuary 2004 - today:

From here on? A hard call because of the item raised in this article.

For the better part of a century now, the global gold trade has been dominated by the US dollar. This will change sooner or later thanks to the US Fed trying to destroy the dollar with exponential fiat-money-supply growth and zero yields, but it still holds true for now. Because of this, all over the world the prevailing gold price is a function of any currency's exchange rate with the US dollar along with the dollar price of gold.

What is happening now in the US and Europe will have huge impacts on the currency rates. Sooner than later we will have a huge FOREX mess and we'll need a new Bretton woods. I'm only wondering how long it will take before we'll get there.

Anybody's view? -

Feb 28 2009

"Irish farmers should be preparing to renew the fight against Brazilian beef on the grounds of carbon footprints, a leading bio-energy expert has warned."

I've repeated it before, despite all the press on the Amazon Forrest, CO2 emissions is something Brazil should not worry about. The emission per capita remained for the least years neatly below 1,8 metric tons per capita. More than 20 times lower than the US emission per capita,; more than 5 times lower than the Belgian emission per capita and more than 3 times lower then the South African emission per capita. In other words: South Africa needs to reduce the CO2 emission per capita by 300% before Brazil has to start working and the US needs to drop emissions by 2.000% (!!) before Brazil is required to take action.

The most interesting is the GDP/emission ration. Brazil scores 2.000 US$ GDP output per metric ton emission, that is higher than the US with 1.936 US$ per metric ton CO2. And honestly, despite all the "green" mumbo jumbo in the current US speech, I believe that Brazil will further widen its lead on the US when it comes to GDP output / metric ton CO2.

And preserving the Amazon? Simple: global payments for ecological services rendered by the Amazon such as the carbon retaining in its forests could go a long way to preserving them, a new study has found. This study is just last week published by WWF; a must read.

Exactly my point: people want Brazil to preserve the Amazon for preserving the carbon retaining capacity of the forest? OK, then pay Brazil for rendering this service. Once there used to be forest in the US and Belgium where both countries put production cpacity without ever worrying of the carbon retaining capacity of those forests.

I'll eat my excellent Brazilian meat (Picanha and piece of Brazilian Mignon with parmesan risotto) in March without any carbon-emission guilt.

-

Feb 27 2009

Excellent visualisation:

-

Feb 17 2009

Excellent points of view:

-

Feb 15 2009

Geert Noels writes on General Motors and Opel Antwerp. General Motors will (of cours) file for Chapter 11; if not next week, then later this year. The reason is simple: the alternative would be a bailout of General Motors. But seriously, where does General Motors needs to invest money when it has a long term vision? In markets like the US or Belgium which have very low growth prospects? Of course not, that would make no sense. No, GM was planning to use this bailout money to invest for example 1 billion US$ in its Brazilian plants; see the article in the Herald Tribune of last week. As Jaimle Ardila, president of GM Brazil-Mercosur puts it:

"It wouldn't be logical to withdraw the investment from where we're growing, and our goal is to protect investments in emerging markets," he said in a statement published by the business daily Gazeta Mercantil."

Only because of this a bailout would never be able to operationalise. The US public opinion would never accept that GM bailout money would be invested in Brazil while 35.000 jobs arte being cutted in the US. Yet purely figure wise GM has no alternative to do so; it's future growth beyond 2012 resides in countries as Brazil.

Have you sen the Chevrolet GPiX crossover coupe that was presented at the 25th edition of the Sao Paulo International Auto Show? The car was completely developed by General Motors Design in Brazil. It's a two-door body car which can drive on all kind of roads. A car build for Emerging Markets.“It offers the sporty design and versatility necessary for a country with the continental dimensions of Brazil,” said Carlos Barba, General Director of Design for GM Latin America, Africa and Middle East; with this project, the Chevrolet GPiX concept could result in the development of many models for Brazil and the Mercosur region.”

GM Design Center Brazil is one of 11 GM studios around the world. Its facilities are being expanded to meet increased responsibilities in the GM global development process. GM is investing US$ 36 million to expand the facilities, acquire new and more modern equipment and hire new professionals. When complete, the GM Design Center in Brazil will triple in size from 3,000 sq. m. to 9,150 sq. m. and the staff will increase from 79 to 190 professionals.The Design Center, which was already one of the most modern in Brazil, will also add next generation equipment to its ‘3D’ virtual reality facility to become the most advanced studio in the country and on par with any automotive design studio in the world.

So, what will happen? GM will file for Chapter 11 and the company will be torn apart. GM Brazil will be a precious gem, since the Brazilian plants are amongst the most modern in the world. Not only the GM plants, but aksi the state-of-the-art Ford maunfacturig plant in Camaçari,in the northeastern state of Bahia; see a video on the plant here. And Opel Antwerp, we will be fully at the mercy of Opel Europe, with HQ in Germany. As if they care what will happen with the tiny plant in Europe where there is a screaming overcapacity.

-

Feb 15 2009

After last weeks update on the South African economy and real estate market, the figures of the Plettenberg Bay Property market show a further drop of 4,8% in the real estate prices for January only. The 2009 South African real estate prospects are a further decline until early 2010.

-

Feb 15 2009

While mobile operators worldwide are struggling to maintain a (profit) growth level above 5%, Vivo Brasil, Brazilian's largest mobile operator, reported a Q4 2008 profit growth of 60,9% compared to last year.

The company closed the year 2008 with 44,945million clients, which represents a market share of 29,8%. Only in Q4 2009, the company gathered 2,668 million new clients. The complete customer acquisition for the year 2008 was 7,561 million new clients. -

Feb 15 2009

Remember the civili violence in South Africa during the month of May 2008? 20.000 foreigners had to be displaced and 60 were killed, mostly in Gauteng, where the violence started.

A report from Johannesburg University of Witwatersrand now warns that such violence will rise again. The report warns that civil violence will soon rise again and that neither government nor civil society is ready to provide effective protection.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...