Some people believed the low South African Rand would stimulate tourism to South Africa; not quite. The South African tourism industry is crying out loud:

"The world wide economic situation has definitely affected the tourism trade in South Africa, but those who have managed to still come to our beautiful country have gone home with wonderful memories and great experiences."

Emerging South

The world upside down.

-

Feb 13 2009

-

Feb 11 2009

Paul Van Cotthem, MD of TurnLeaf (check out the weblog to learn more on the great work they are doing for Yuntaa, Nomadesk and others) just send me this excellent article published in the Economical Times Today on the state of the South African economy.Next to the worries the Economical Times has on the economical prospects of South Africa, which I completely share -most of my Emerging South posts on South Africa since early 2007 focus on these problems-, the article in the ET transpirates a very big concern on the leftist move of South Africa after May 2009, when the new (ANC) president will take seat. I have written a lot on my views with regards to Zuma and the state of the ANC. Zuma will opt for the Chavez scenario instead of the Lula scenario and that will be a huge lost opportunity.

As to the South African economy; the tendency is not good at all.However, the biggest problem of South Africa is the absolute naive denial of South Africans to cope with the reality of the situations.

The typical articles you will read in South Africa read like this one "Will consumers spend South Africa out of trouble"; the interestrate goes down and therefore spending will solve everything. You will even read articles like this these days: wherePam Golding agent Richard wright states:

“My advice to investors is to stop waiting – you‘ve got about three or four months to purchase properties because by the second half of this year we will see prices rise again,” said Pam Golding agent Richard Wright in Port Elizabeth.

“Anyone who has money in the bank now can afford to negotiate a lot.”

South African real estate prices going up in the second half of 2009? Keep dreaming. Remember: only 16% of the South African don't have debts, 11% missed at least one downpayment and 33% simply say they are "drowning in debt". The problem with (South Africans) is that they culturally never learned how to save; these are not my words, anyone will confirm you that South Africans drowned themselves in debt the last decade.

And when people are drowning in debt, no interest cut will help; this excellent article explains why through a beautiful metaphor. -

Feb 8 2009

Dominique Strauss-Kahnan announced yesterday that the industrialized countries are now officially in a depression. No news to me. People like Roubini are having a great laugh with all the short-sighted positivists who only last September even fighted the idea that the US was entering a recession.

Depression:

A proposed definition for depression is a sustained recessionary period in which the population is forced to dispose of tangible assets to fund every day living, as was seen in the US and in Germany in the 1930s.

hough there is no widely accepted definition for an economic depression, according to an article in The Economist, there are two rules of thumb found widely on the internet. One is a decline in real GDP exceeding 10%, and the other is a recession lasting 3 or more years.

Actually, just as Sunil Kewalramani, CEO of Global Capital Advisors, I believe 2009 could be worse than the 1930 depression.

Roubini sees as only way out of this mess a nationalization of the banks. I second that. But people like Geert Noels fiercely fight that idea and still do so today.

Geert Noels rather points a finger to the IMF itself as the culprit.

The problem is of course not the IMF as an institution. The problem is that the last 5 years the G7 countries refused to give out the leadership of the IMF to a leader from the Emerging Countries. Read this excellent note from Sebastian Edwards on the matter, dated March 2006. Imagine how the world would look like if someone like Alejandro Foxley would have been leading the IMF since 2004?

Not surprisingly, the most knowledgeable people on crisis prevention and crisis resolution are in the successful countries of Latin America. After decades of instability, a handful of Latin countries - in particular, Chile and Mexico - have become an example of prudence, austerity and macroeconomic stability. These Latin American nations have learned the hard way. Their leaders understood that to achieve prosperity and social progress, a combination of good economic policies, political realism, and well-funded social programs was required. -

Feb 7 2009

-

Feb 7 2009

A very interesting discussion on which BRIC countries will be most affected by the crisis on Linkedin. This view of Larry Cristini, Political Risk Consultant at Eurasia Group is an extremely intelligent answer on the question:

-

Feb 5 2009

An increasing amount of questions in the Plettenberg Property market: what was the true nature of the dealings between Rudewan Arendse and Ruwaad holdings?

-

Feb 5 2009

Ago just send inthe link to this excellent report of breakingviews with key 2009 predictions.

I especially liked the simple analysis on Brazil on page 25 and 36:

"For sovereign debt, the countries in favour will have little political risk and broadly diversified economies, as well as governments that are unlikely to indulge in expensive stimulus packages or bank rescues. Triple-B rated Brazil fits that bill, and it even appears to be avoiding recession through domestic growth, not to mention high real interest rates that can be cut if necessary." -

Feb 5 2009

When oh when is De Morgen going to give Lode Delputte the boot? The man basically writes every piece on Latin America in De Morgen and is o so biased. The man even never lived in Latin America, traveled some times up and down and considers and confuses his very coloured political views with journalism. Today he wrote a piece in De Morgen on crime in Sao Paulo. He takes the PCC, some rumors he must have heared on what is happening in Paraisopolis and writes a story. It is clear the man has no clue of the history of the Primeiro Comando do Capital; let be of what is going on in Paraisopolis.

The problems in Paraisopolis started with abusive PMs entering the favela; you can read all on it here. Yes, the PCC is a criminal gang; but they have a huge support in the local communities; not only by criminals. If you truly want to report on crime in Sao Paulo, you need more than Lode Delputte's shallow articles.

What was most disturbing in the article however was the only piece of factual information it contained, quote:

"Omdat de moordcijfers er hoe dan ook erg hoog liggen -120 per 100.000 volgence cijfers die vorig jaar op de Urban Age conferentie werden geciteerd-". 120 homicides per 100.000 ?!

Why is this so absurd?

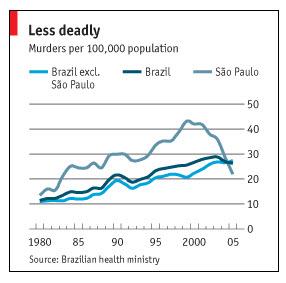

1. To begin with: the source that Lode Delputte mentions, Urban Age, has no homicide data whatsoever and never published homicide data on Sao Paulo. 2. Secondly: you will find in no publication whatsoever a Sao Paulo homicide rate higher than 45 per 100.000 (whereas Le Delputte mentions the absurd figure of 120. That peak happened in the 1990s when Sao Paulo saw a bulge in the proportion of 19-24 year-olds, which coincided with a rise in youth crime. Even in the most crime-ridden favela of Sao Paulo, Jardim Ângela, a poor suburb of São Paulo, the peak crime rate has never topped the 112 murders per 100.000 in 1995.

2. Secondly: you will find in no publication whatsoever a Sao Paulo homicide rate higher than 45 per 100.000 (whereas Le Delputte mentions the absurd figure of 120. That peak happened in the 1990s when Sao Paulo saw a bulge in the proportion of 19-24 year-olds, which coincided with a rise in youth crime. Even in the most crime-ridden favela of Sao Paulo, Jardim Ângela, a poor suburb of São Paulo, the peak crime rate has never topped the 112 murders per 100.000 in 1995.

3. What Lode Delputtefails to mention is that crime in Sao Paulo has seen a drastic decrease since 2000; actually the murder rate in the state of São Paulo has been cut in half since 2000. As a journalist, Lode Delputte should have known of the "unsung story of Sao Paulo's Murder rate drop. Why didn't you write about this downward trend. Real journalists wrote ablout it in The Economist. Have you ever heard about the recent "Dry Law" and its impact on crime? The data that Lode Delputte publishes is 600% higher than the data the Economist publishes. Who do you tend to believe: the economist or some obscure biased Belgian journalist?

4. Actually, the murder rate in São Paulo dropped below 20 per 100.000 in 2008. This is a lower homicide rate than the following American cities in 2007:

Atlanta

Baltimore (45:15 more than Rio)

Buffalo

Cleveland

Detroit (46: 16 more than Rio !)

Newark (more than Rio !)

Oakland (same as Rio)

Philadelphia (!)

St Louis

Washington (Washington has a slightly higher homicide rate as Rio !)

Any country requires a healthy dose of critical journalism, also Brazil.

But such journalism needs to be factual; and if there is one element on which Brazil is proceeding in the good direction, then it's crime.

I wrote Lode a mail pointing him to the ridiculous facts he states in his article; let's see what he responds. -

Feb 4 2009

I wrote earlier this week on my worries on the South African real estate market. My worries are growing with the day. On a worldwide scale, the Obama enthusiasm is quickly fading away. Willem Buiter writes an excellent piece on it today "YES WE CAN !!! have a global depression if we really to continue work at it..." Back to South Africa: next week Manuel Trevor, South Africa's finance minister has to unveil his national budget, it will be his toughest shot ever, the country is extremely vulnerable to the current crisis. More worrying is the Port Elizabeth news that I received today from Amazing Estates on the Coega harbor investments in Port Elibzath being halted. Add to that the growing concern on the FIFA worldcup in 2010 in South Africa and you understand my increasing worries. Als the state of the Plettenberg property market is looking worrying.

-

Feb 4 2009

From a Belgian perspective I believe global protectionistic measures would be a true disaster for the economy. Vincent hopes for an optimistic outcome optimistic and the news today was somewhat soothing. Yet Vincent also points out to these Apocalyptic outlooks of Macroman. Indeed: the LIBOR rates are raising again and as I predicted before, inflation will be again on the raise in 2009.

As to protectionism: it is here to stay. Geert Noels refers to Paul Krugman who is actually srongly supporting US protectionistic matters. And it would make sense for the US, and Brazil, and... but not for Belgium. Our open economy would evaporate in a matter of years. And yes, as Geert Noels points out in the same article: we urgently need new stability in the exchange rates; but as I pointed out before: I don't see this happening soon.

My advice: maintain (or even acquire) heavy positions in real assets, make smart decissions when picking the domiciles of those (and the currencies) and then accept volatility that comes with it. And keep a close eyes on the authority of that country; when you detect white foam around the mouth as in South Africa: run.

Any better advice for asset protection? Let me know !

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...