Yesterday the Financial Times published an excellent well-balanced article on Brazil's state in the current economical turmoils.

"2008 highlighted the importance of Brazilian domestic consumption. Growth remained solid due to flourishing but conservative lending and well run groups in sectors such as retailing and telecoms. Countries spending on infrastructure to stimulate their economy (like the US, China,...) will need iron, so hard commodity prices should rise in the longer term."

You can find the full article here.

While in Europe and the US architects are all falling without working and see their revenue falling like a rock, in Latin America architecture firms are all growing.

"In recent years, as many major U.S. architecture firms expanded internationally, they often bypassed Latin America in favor of Europe, China, and the Middle East. Gradually, though, that may be starting to change, as architects open offices and enlist for projects in Central and South American countries, where population and economic growth have been strong in recent years. Even as financial troubles mount around the world, and increasingly put some Latin nations at risk, there’s a sense that much of the region, which has been buffeted by severe recessions before, can weather the current crisis.Another driver of Latin America’s building boom is tourism. Despite a global drop in travel due to the economic downturn, Bryan Algeo, AIA, principal of WATG, an Irvine, California-based firm, says the Latin American tourism industry shouldn’t be as badly affected as other parts of the world because the region’s still relatively affordable compared with other destinations."

Emerging South

The world upside down.

-

Jan 9 2009

-

Jan 9 2009

The sub-Saharan economy is doing well, very well. The economy grew with 5,4% in 200. South Africa is an exception with a collapsing economy. Some people like Mr. Wayne McCurrie believe in their naivity all will be well again. My personal views on South Africa are very black, especially real estate wise and the political troubles don't really help. The ANC indeed needs more people with humility.

Cape Town Property Bubble used to be a good source to keep an eye on the crashing South African real estate market, but the editor fell asleep. I wished he published as frequent as the Belgian real estate property bubble blog. This blog on the South African Real Estate market is a good alernative. The South African real estate market was one of the first worldwideto show cracks and will be one of the last markets to gain stability. -

Jan 7 2009

Some people really don't get it. Wayne Mc Currie of South African RMB Bank is one of them. Soon the South African Reservee Bank should announce the December inflation figures. In November the CPIX consumer price index was at 12,8%, coming from 13,6%. 12,8% is still massively high (by way of comparison, the consumer inflation index of the last 12 months in Brasil was 6,39%, less than half the South African inflation.

Now Mister Warne Mc Currie claims:

"Now in South Africa, to divide our market into two - the non-resource shares - we know there's good news coming. So with the banks, the retailers, we know interest rates are coming down, inflation's coming down, the price of petrol's coming down - despite what the oil price has done in the last couple of days. But after the peak it's actually a massive fall - when diesel went above R12 and petrol went above R10/litre. So there'll be a massive fall. Of course, in the next three/four months the inflation numbers are just going to plummet. So we will see further - and quite significant - interest-rate cuts. So for let's call it the consumer shares, the outlook is actually reasonable. We just don't know yet about the resource shares. Now, they have rallied. Some of the resource rallies have actually been strong, simply because they fell so much."

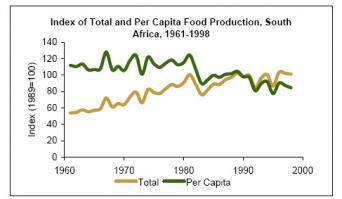

The simplistic man believes that all will be well just because inflation is coming down a bit (but still double digit); mainly because oil prices went down. The man fails to talk about South Africa's massive negative current accounts, the painful fundamentals of South African's energy-import depence, the fact that South Africa became a net food importer. And worst of all, Mr. Wayne Mc Currie fails to understand the massive negative impact of South African's Brain drain: more tha n 2.100 South African doctors are emigrating to Canada, mainly because of the skyrocketing crime in South Africa. And when Mr. Wayne Mc Currie believes consumption will be the "all good like before" in South Africa; he should check the fundamentals and understand that South African's are already swimming in debt. A slightly lower interest rate won't structurally solve this. -

Jan 4 2009

It is my belief that that the coming decennium will be one where self-sufficiency in water, energy and food will be at the heart of the success of the economy of any country. Belgium scores terribly bad on each of those parameters, even when it comes to freshwater reserves. Brazil is the world's best performer on each of the 3:

1. More than 80% of the Brazilian electricity comes from hydro, more than half of the cars drive on ethanol, the country discovered vast oil reserves

2. Brazil has the biggest freshwater reserve of the world

3. Brazil is the biggest food exporting country in the world. It ranks third on exports with 34,4 billion US$ of food exports. Bigger than China with 27,86 billion US$ of food exports. But contrary to China, which also imports 22,92 billion US$ of foods, Brazil is only a very very tiny importer of food. The country imports less than 5 billion US$ of food products andeven doesn't rank in the top 5 list. This in sharp contrast with South Africa. Bloomberg announced recently that South Africa become a net food importer last year for the first time since 1985. The country exported 29.9 billion rand ($2.9 billion) of agricultural goods and imported products valued at 30.3 billion rand. The European Union remains South Africa's most important export market, while imports are sourced mainly from the Mercosur countries, in particular Argentina and... Brazil... South Africa's main exports are wine, fruit and sugar, while its largest imports include rice, ethyl-alcohol, wheat and oilcake. Yes, Brazil is both a big wheat and rice producer.

This in sharp contrast with South Africa. Bloomberg announced recently that South Africa become a net food importer last year for the first time since 1985. The country exported 29.9 billion rand ($2.9 billion) of agricultural goods and imported products valued at 30.3 billion rand. The European Union remains South Africa's most important export market, while imports are sourced mainly from the Mercosur countries, in particular Argentina and... Brazil... South Africa's main exports are wine, fruit and sugar, while its largest imports include rice, ethyl-alcohol, wheat and oilcake. Yes, Brazil is both a big wheat and rice producer.

This news is dramatic for South Africa. The democratically elected government of South Africa is forcing white farm owners to sell to the government which turns large white-run farms into many small black-run farms. One result is that food production is dropping. Since the trend of pushing whites off the farms will continue South Africa's food production will decline and the parallels to Zimbabwe will increase. Since the more talented younger whites mostly have left or will leave the real crunch is going to come as the older skilled whites get too old to work and die off. Zimbabwe shows where South Africa could end up. -

Jan 3 2009

Excellent column of Casey. B Mulligan in The New York Times on the pervert side effects of the bailout plans.

-

Jan 3 2009

It's in every newspaper and magazine these days: Global Property Guide published the overview of 2008 and basically everywhere the real estate prices are sinking. Only Latin America seems to be a safe have these days. Although I would be very, very reluctant to by property in Panama these days. I spent a year in Panama in 2002 and scouted the market. Still one of my favorite places on the world for living, but prices have become way too inflated since 2002 to deserve the "buy" label today.

-

Jan 1 2009

I've always been a strong opponent of the bailout initiatives, especially the US one. I also belief that all the support funds of the American and British government to massively financially support tech startups will fail to make any difference. Contrary to Bart Becks I don't believe that our priorities are now to give every kid access to the Internet or have our governments dig more debts to allow would-be-entrepeneurs to play instead of work. Despite the efforts of a decade, the tech startup market hasn't really yet contributed to substantial job creation; the kind of job creation that can offset the job losses ahead.

-

Dec 26 2008

The worldcup of 2010 in South Africa will be quite an event. But football and South Africa cannot match the affinity Brazil has with soccer. South Africans are into Rugby and golf, not into soccer.

And only when you have experienced how Brazilians live the worldcup, you can truly realize how big an event the 2014 Brazilian worldcup will be. Add to that that economically wise the country will be living Hay Days in 2014 with the Petrobras oil finds being pumped up and the commodity prices sckyrocketing again.

This will be the second time Brazil will host the competition after the 1950 FIFA World Cup. It will also be the first World Cup to be held in South America since the 1978 FIFA World Cup, which was held in Argentina. You cannoy imagine how big an event this will be for Brazil and Brazilians. Last September, the Brazilian Transport Ministry already announced a high-speed train project for the world cup connecting Sao Paulo, Rio de Janeiro and Campinas. This will basically connect Rio to Sao Paulo as Paris and Brussels are connected with the TGV.

According to the current FIFA practices, no more than one city may use two stadia and the number of host cities is limited between eight and ten. The Brazilian Confederation (CBF) already requested permission to assign twelve cities hosting World Cup Finals.

Yesterday I read in the Portuguese economical newspaper Economica that the Portuguese architect Tomas Taveira (yes, right, he also featured on "Queres óleo" and "Vamos comer a Fatinha" in the 90s), was asked by Santa Catarina to do studies for a new stadium for Avai Futebol Clube in Florianopolis. Taveira build the Estádio Municipal de Aveiro, Estádio José Alvalade and the Estádio Dr. Magalhães Pessoa for the Euro 2004 in Portugal. When I read the article I told my wife "look, Florianopolis is also competing to be one of the 12 cities to host the 2014 World Cup". She was sceptical, since Porto Alegre and Curitiba in the South would already by hosting cities and the country needs to 'balance its act'. But look, today Globo published this article:

Rio de Janeiro, Sao Paulo, Belo Horizonte, Brasilia and Porto Alegre are surely on the list. Curitiba cannot be pushed out. That makes 6 cities already. Add to that one city in Amazonia and Pantanal. That brings the list on 8. Then 3 cities in the North East (probably Recife, Salvador and Fortaleza), that brings the list on 11. Which leaves the last places to be fought out between Goiânia e Florianópolis. You've probably never heard of Goiânia in the Central-Western Region of Brazil; don't underestimate the city with its 1,3 million habitants; yet I personally favor Florianopolis for winning the bet. -

Dec 21 2008

The currency exchange markets are entering in one of their most volatile periode ever known in history. We had meetings with our bankers last week and the premium you pay for a Non Deliverable Option (NDO) for 3, 6 and 12 months are at record highs. Foir the EUR/BRL you will pay a 15,95% premium for an NDO ! Imagine what you can do in such a market when you have brains...The spread for strikes in a non delivereable zero-cost tunnel is also aburdly wide.

Personally I have very bit questions about the absurd low intrest policies of the Fed, ECb and BoE. Everyone with some brains in his/her head knows that will be facing super inflation in 2, 3 years from here. Why would any person/company then take the risk during this short period of Quantitative Easing to take investment risks when your risk will pay off, inflation will hit full force again. Willem Buiter wrote an excellent piece on this in the Financial Times this weekend. This is why we will be heading for a lost decade of stagnation, whatever the central banks will do (and they are now at the end of their story with these bottom rates).

Which is why 2009 will offer a very strong real estate opportunity; at least in countries with a housing deficit (read: not Flanders). 2009 will allow you to buy in at deflationary prices; you can develop at artificially low construction prices (steel, cement,... have all plumetted in price) and real estate is the best insurance for the inflation storm ahead. But at all cost: don't apply this theory in Western Europe.

As Carlo Resta wrote in his excellent article on RGE on the future roles of central banks:

"To perform their fundamental function of establishing financial stability, Central Banks will have to recur to a new kind of active presence. “Perimeter of Regulation” was the past. In the post crisis world, and in the transition period as well, Monetary Authorities will have to be out in the marketplace to properly interpret their role in a new global order. They will engage in new functions, to effectively gain key information with important market players and engaging them in a process of cooperation and exchange, restoring confidence, financial markets soundness and achieving global governance.

The new world will seal a radical change that is taking place in the evolution of the global economy and of the political order. The emerging economies will play a crescent role and a bipolar era will open to a multi-polar one. To properly solve the equation of balance and growth in the future, the variables to be solved will be a multiple to include the growing economies. Central Banks are now challenged in a different way and new targeted exchanges, key information gathering and global coordination are necessary. The first G-20 summit on Financial Markets and the World Economy that took place last month in Washington is a confirmation of the need for a new Central Banks presence. That the world authorities had a sense of fear and they showed up with a strong response is a positive thing. The world has changed and so the role of Monetary Authority. The near and long term challenges are really of difficult and unprecedented nature. Yet, in an ever interconnected world each of us has an interest that the unbalances be resolved."

If only Belgian politicians would have a clue of the real nature of the challenges ahead. -

Dec 14 2008

The Wall Street Journal was very dark this weekend on the US Outlook for the coming quarters; the worst is indeed still to come, but contrary to the Wall Street Journal, I don't believe that the recession will be over in June 2009, it will take all the way through 2009.

Meanwhile, Brazil's new strategy for maintaining investment and expanding credit is reducing interest rates on loans granted by Bank of Brasil and Caixa Economica Federal (Federal Savings Bank). Which is, I think, a very smart plan. Here in Europe the ECB is cutting down interest rates massively, but this is not dripping through to the companies and people in the street. In Brasil, the Reserve Bank hasn't dropped interest rates yet; I'm happy for this, since I believe in Europe and the US we are creating a massive hyper-inflation tornado coming our way; and not in the least also in South Africa, where the Reserve Bank lowered the interest rate last week.

In Brazil the credit market is somewhat atypic; you need to understand the structure of Bank of Brasil and Caixa Economica for this. Caixa is omnipresent, all worker people put their saving money (Poupanca) at Caixa. And most of the housing credit is provided through Caixa. Contrary to the US and Europe, housing credit in Brasil is small; luckily. Real estate financing only amounts to 4% of the GDP. What Brasil now wants to do is keep the Reserv Bank rates the same, but reduce the spreads (difference between the interest rates that bank receuves and what they loan to third parties) by inforcing Caixa and Banco Brasil to lower their interest rates. This would mean banks in Brasil would make less profit; which is perfectly fina, since they have been sitting on ever increasing mountains of profit the last years. Also the PAC (Growth Acceleratioon) Investment Program will be paintained, income taxes will be lowered and the Financial Operation Tax (IOF) will disappear (excellent news for foreign investors), although only for natural persons. Also the IPI (Industrialized Products Tax) will be lowered and the Central Bank will use their reserve funds in dollar auctions. The tax waivers from fiscal measures will total 8,4 billion R$.

This weekend Forbes published an excellent article on the Emerging Markets: Asia and Latin America: China, Hong Kong and Brazil are the places to be.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...