In 2014 the World Soccer Championship takes place in Brazil. Florianopolis is next to Rio de Janeiro one of the host cities.

Chances are that the 2016 Olympics would also take place in Rio; the 4 remaining candidate cities are Tokyo, Chicago, Madrid and Rio de Janeiro. Rio is doing a great job in the bid and apparently als the genral public thinks Rio makes a good chance, with 48% of the votes; second is Chicago with 30% of the votes. As much as I would love to see the games take place in Rio and as much as I think Latin America deserves that honour, I think Obama will make his mark in organising the games in Chicago. Let's all vote for Rio !

Emerging South

The world upside down.

-

Dec 13 2008

-

Dec 12 2008

I wrote before that the ANC in South Africa is facing hard times, especially in the upcoming 2009 elections and certainly in the 2014 elections. In a poll lost week, the ANC breakaway COPE (Congress of the people) party, ,would have received 12 of the 27 seats, the Democratic Alliance party 10 and the ANC, which previously held all of the seats only... 3.

Just as Andrtew Feinstein predicted in his book "After the Party". -

Dec 12 2008

Update December 13th: average of 20 predictions is that 1 Euro will yield 3,14 BRL on December 2009; that's a little bit less than what it yields today (3,14). I remain with my position that the Euro will lower to 2,53 Reais by end 2009.

The first question in the new set of 10 prediction questions for the coming: what will the EUR / BRL rate be on December 31st 2009?

My prediction is 2,53, what is yours? Vote here (caution: use . instead of , as a decimal marker) -

Nov 30 2008

It's no secret that I'm not Zuma's biggest fan (only Gwen Stefani can be crazy enough to call her newborn child "Zuma"). I believe the ANC in its current shape is a serious threat of bringing SA in a politically (and economically) very unstable position. The ANC tried to soothen the emotions last Friday by stating:

"Our continued political stability therefore depends on the vigilance of political parties, social leaders, the trade union movements, institutions monitoring democracy as well as ordinary citizens who stand to lose the most should our stability be compromised,"

Not convincing to me. The ANC is planning to radically increase the social welfare net; whereas South Africa simply doesn't have the money for this; their current account deficit is already bleeding red. A shortlistof the plans in last week's manifesto:

1. Extension of the 240 R child support grant for an additional four years until a child's 18th birthday. This will add 10 billion R to the existing 100 billion R social welfare budget.

2. An unspecified additional "care-giver's benefit" for mothers. Let's take they will give 100 R a month and assuming 2 million SA mothers, that brings an extra 2,4 billion R to the budget.

3. An undefined grant for young people between 18 and 25 to help them get into the labour market (South Africa currently has an unemployment rate of close to 25%) This could be a version of the job subsidy now being considered by the Treasury at a lmikely cost of 20 to 30 billion R a year.

4. Income support for all adult South Africans, which, if it is based in the basic income grant proposal, would be reversed for working people through taxes. In 2001, the cost of a universal 100 R monthly basic grant was calculated at 48 billion R, of which between 15 billion and 20 billion R would be a cross subsidy from taxpayers. This means a neto state subsidy of between 33 and 28 billion R.

Adding all the above together, the current 100 billion R social welfare budget would go up between 60,4 and 75 billion R. That is an increase of 60 to 75% !

Next to that, the ANC foresees additional expenses:

1. Ensuring that 60% of schools are no-fee centres by 2009. I actually believe this expense pays of as a future-investment.

2. Reducing serious and violent crime by 7-10% a year and reducing the rate of HIV infection by 50% by 2011. Noble but laughable targets considering the crime and HIV state SA is currently in.

3. Implementation of the government's mandatory retirement savings scheem. This would literally make the SA social welfare budget explode (only the old-age grant of this plan would push the bill from 19,4 billion R to 27,7 billion R).

4. One million new houses over the next five years, which roughly matches the delivery rate since 1994.

5. Putting the brakes on the escalating cost of home building, which the government plans to achive by price control or a state subsidy. Yes, you read that right....

Where the ANC plans to find all this money?

"Through higher taxes or increased borrowing". Yeah... right.

Iraj Abedian, chief executive of Pan African Capital Holding, says a programme like this would require economic growth of minimal 6% every year. At the same time, finance minister Trevor Manuel foresees SA growth of just over 3% for the next few years and most ecoomists put the figure at around 2% for the next two years.

The ANC draft manifesto also promises to increase state employment, "shield workers from the devastating effects of the global meltdown by tightening labour protection laws and plouygh more money into health and safety".

The above plans are going to be finalised byu next January; Zuma uses the phrase "continuity and change" when he refers to the plan. I still have no clue where he sees the continuity...

Brait economist Colen Garrow said it was clear that "the populist tilt to the left is definitely under way. The big question is how are they going to fund it".

The message is clear: the above plans will be funded by debt, massive debt. Manuel Trevor warned last week that the days of budget surprluses are over and forecasts that the government would slip into R41 billion next year.

Meanwhile Bloomberg announced yesterdaythat the South African trade deficit widened unexpectedly from 9,8 billion R from 7,1 billion R in September. This shortfal was (much) bigger than the 5,9 billion R median estimate. There is also word that the South Africa Reserve Bank may cut its main interest rate on next December 11th. People like Ian Cruickshanks, head of research at Nedbank Treasury in Johannesburg will try to convince you that against all logic "Lower interest rates will have a marginally positive effect on the economy, which could at least stem a possible further decline in the rand"; absurd of course: the SAR will fall when the SA Reserve bank announces a lower interest rate. -

Nov 23 2008

Last Thursday, the United States government intelligence (NIC) publised a 120 page report in which it predicts the global trends in the year 2025. The report is used to better inform US policy makers.

The report got a lot of attention in the press, especially since it paints a very bleak future for Western society. Personally I'm shocked of the sheer denial of the European business society on the future of this continent. Kishore Mahbubani writes in an excellent way how catastrophic this denial will be to us (a short video of him below this post). However, he should read this other great book on the coming power struggle between India, China and Japan.

Personally I'm shocked of the sheer denial of the European business society on the future of this continent. Kishore Mahbubani writes in an excellent way how catastrophic this denial will be to us (a short video of him below this post). However, he should read this other great book on the coming power struggle between India, China and Japan.

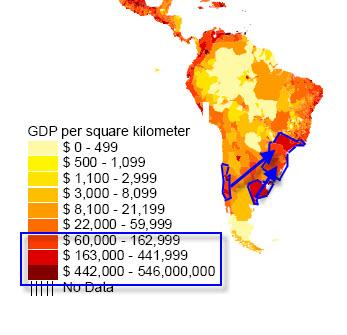

Personally I'm a very strong believer in the future of Southern Brazil which covers an enormous area where the GDP per square kilometer is already today as big as in the US and Europe; and contrary to those European and America areas, the growth potential of this Southern Brazilian space is big.

Brazil is mentioned 33 times in the intelligence report of the US. South Africa is only mentioned once, on page 43 where the authors mention that China, India and South Africa will be in a huge demand of nuclear power. Not Brazil, since their electricity comes for 95% from hydro, their cars drive for a big deal on ethanol and as the report mentions Brazil's position as one of the biggest oil exporters in the world by 2020.

As to Europe, the NIC report concluded the European Union will maintain its economic clout in 2025, but internal bickering and competing national agendas will leave the EU a "hobbled giant" unable to translate its position into global influence.

My kids will be in university in 2025.

The full report can be downloaded by clicking here. It is a must-read. -

Nov 20 2008

The auto industry in the United States is attempting to employ the same scare tactics used by Paulson to get Congress to approve a $700 billion bailout for banks on Friday October 3. Please remember that we were told huge measures were needed to prevent a stock market collapse. I wrote back then that the Paulson bailout plan was a stupid idea, the results sofar proof my point:

1. The S&P collapsed from 1114 on October 3 to 848 today, that is a drop of 24%

2. Bloomberg has filed a lawsuit against the Fed under the Freedom of Information Act to find out just how Paulson has used the money.

3. Not a single job was created with the money.

4. Fannie Mae has announced it may need another $100 billion.

Now US cities and the auto companies want a share of the cake.

A bailout plan for the US auto industry is as stupid as the October 3 bailout plan.

Why? Today, auto employment by USauto companies is insignifcant, it has been dropping massively since 2000. And employment of foreign owned companies doesn't cover a fraction of the job losses in the US. When you goto the sea port of New Jersey, you will see acres and acres of parking lots waiting for unmarked foreign ships to dock and disgorge millions of cars made overseas for foreign-owned corporations. Cars coming from South Korea, Japan and... Brazil !

Actually, Ford's most advance assembly line in the world is in Brazil. Check out the video, it will be an eye opening experience in auto manufacturing. The plant is based in Camaçari in the Northeastern state Bahia. Ford cannot build such a plant in the US because the UAW will not allow such supplier integration. -

Nov 16 2008

Just look how Brazil is shining with India and China at the G20. Lula and Hu squeezing Bush, literally. "We need new, more inclusive governance, and Brazil is ready to face up to its responsibilities," Lula said at the meeting of finance ministers and central-bank presidents in São Paulo.

For years, critics said that Brazil was long on potential and short on performance.

Not anymore. The massive country has become one of the world's biggest democracies and an economic powerhouse. Now Brazilian President Luiz Inácio Lula da Silva wants his nation to have a bigger role in world affairs. In the short term, Brazil wants the smaller G-7 group of industrialized countries to expand to include Brazil and other developing countries. He wants a permanent G-14 with Russia, China, Mexico and India among the additions. Brazil also wants developing nations to have a greater voice at the International Monetary Fund, the World Bank and the United Nations.

Basically, what Lula is sayingis that excessive latitude of action was given to European countries during all the decades after WWII.

Brazil learned its lessons during the 90s with hyperinflation and political instability.

However, Lula has promoted business investment while putting more money into the hands of the poor. The economy has boomed for three years. With the world's 10th-biggest economy, Brazil has surpassed the United States as the biggest producer of iron ore and coffee. It's become the world's biggest exporter of beef, poultry, biofuels and orange-juice concentrate, and is rapidly gaining in soybeans, corn and pork.

Brazil has also accumulated 200 billion US$ in foreign reserves, almost as much as the rest of Latin America combined. That money will help cushion the global meltdown.

Now, Brazil wants to be recognized for its fiscal track record and to avoid the risks that come with a global economic crisis.

-

Nov 13 2008

We rarely work with our homebanks for Forex trading, on the lonely exception of one they are all way too expensive and slow. In Brazil we have been working with Number One for more than years now. They are truly exceptional. We have a very clear framework agreement with them and they are extremely fast and professional. I can hardly think of a more efficient broker. Actually, Number One has an excellent content section on the Brazilian Real; some content is public, the best content is exclusive to Number One clients.

All this in sharp contrast to the broker we have been working with in South Africa for the past year. Banking in South Africa remains prehistorically slow and expensive when compared to the efficient banking system in Brazil. I have been trying to getsome non-resident money (read: even no Reserve Bank clearance needed) out of South Africa for the past 10 days and things simply don't happen. I had been promised the money would leave last Monday and again... nothing. This is unseen to me.

Anybody who has recommendation for fast, communicative and competitive South African currency brokers of the profile of Number One in Brazil? -

Nov 11 2008

Emerging South has been around for a year now.The ambition was mainly to keep entrepeneurs of and in Brazil and South Africa connected on the economical context and facilitateexchange. The latest weeks there has been a considerable increase in traffic:

1. Since last week more than 200 people follow this Blog via an RSS feed.

2. There are on average 300 unique visitors a day on the Blog. 90% of the traffic is from people living in South Africa, Brazil, the UK, United States and Belgium.

3. TheEmerging South Linked In group has more than 33 members, you can join here.

Thanks to Dieter, Silverstripe and Open Minds for the excellent infrastructure building blocks. -

Nov 6 2008

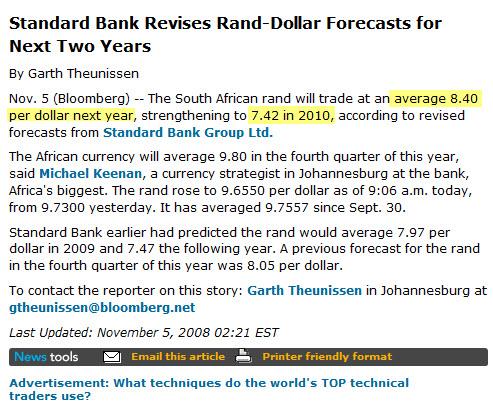

Currently the ZAR trades at 9,845 against the USD. Bloomberg just posted a report in which they estimate the ZAR could trade at 8,4 against 1 USD in 2009 and 7,42 against 1 USD in 2010. This would mean that the ZAR would gain 24% from now till end 2010 (read: some months after the election of Zuma as the new SA president). I follow the Bloomberg line of thinking. With some considerations through the fluctuations through 2008 and 2009 though. The volatility in the coming months will be extreme. Especially since I suspect that (1) the inflation in South Africa will remain well above 13% in October (results not yet published, they are kind of slow in SA publicising inflation index figures), November and Q1 2009. The fact that the SAR plummeted recently, fuels the SA inflation.

So, I think you will have various buying opportunities to get into the ZAR today. I believe the chance for a +20% currency gain by end 2010 is very likely. Just make sure you have an iron stomach when the SA Reserve bank decides to lower their intrest rate from the current 15,5% any time soon, you'll see the Rand fall down to historic lows.

The question then of course remains what the USD will do against the EUR by 2010. Still around 1,25 EUR for 1 USD? Higher / Lower? Much harder to do predictions on that one.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...