The last years I have had an ever growing despise of having to fly South African Airways. The airline's evolution has many parallels with the evolution of South Africa as a country:

1. An sudden increase of black management. The "positive discrimination" of blacks caused a current number of 240 technician vacancies and 53 pilots vacancies. 217 technicians resigned last year; you can imagine what the quality is of the ones left.

2.The losses of Souh African's airlines totalled 13,7 billion South African Rand between 2002 and now. That is more than 1 billion EU ! Meanwhile, the salary of Khaya Ngquala climbed from 2,3 million SAR in 2004 to 5 million SAR today. In 2005-2006 he also received a performance bonus of 1,85 million SAR; god may know why. Seriously, just look at the man who is running SA; I wonder if anyone would actually understand his English. Meanwhile, the(AN) ministers have no considerations whatsoever replacing Ngquala.

3. SAA is government supported; since 2004 SAA absorbed 12 billion SAR in government support; 9 billion SAR in cash injections and 2,86 billion SAR in guarantees.

The worst however is the absolute despise of the (black) personnel of SAA towards their customers. On our last flight from Johannesburg to Brussels (where we had a 1h45min stopover in Munich, more than enough time); the person at checkin refused to board us also on the Munich to Brussels flight; which is standard procedure. While at the checkin counter in Joburg, we looked to the board of the flights leaving and we saw that the flight was leaving one hour later then mentioned on the tickets. We asked the guy at checkin and he said it was probably just a flaw of the board. We of course knew that the flight would leave at least 1 hour late and that therefore they couldn't boardus into the Munich-Brussels flight (systems don't allow when stop-over flight leaves less then 1h after the scheduled arrivalof the flight from Joburg). We went to a black supervisor. A typical Johannesburg black woman, who could barely speak decent English and probably was recently promoted from cleaning lady to checkin supervisor. The conversation with that woman was hilarious. Just us being white she was already in the defensive and stating; never did it cross her mind that we were actually customers and that our satisfaction was her job. She never admitted the plane would leave late, she even had the announcement board changed to the original departure hour. We didn't get our boarding passes for Munich, but the plane in Joburg did leave 1,5 hours late (we had to wait after they allowed us in the plane). Luckily in Munich, the efficient, friendly, well-trained and smiling Lufthansa people helped sorting everything and brought us quickly to Brussels. When we mentioned our troubles with South African Airlines, they smiled and said "we are used to it". If you think Lufthansa will ever even consider taking over SAA: keep dreaming.

And I'm certainly not the only one with these horros stories. Actually, the situation is getting that bad that South Africans are opening complaint sites. Recently "SAA sucks" has been opened. The site is setup by a well-known SA journalist and is getting massive support.

Also good news: my favorite South African national carrier is now 1time. They are competitively priced; very spatious,always on time, withfriendly, well-trained staf. Contrary to SAA, 1time is not subsidized by the SA government, so they do know what customer satisfaction means. Also good news is that 1time won bigtime in the hedging camble ! Just like Ryanair they decided not to hedge when oil was at 100 US$, which means they... won.

Emerging South

The world upside down.

-

Nov 2 2008

-

Nov 2 2008

A long overdue update on the Brazilianand South African economy. I included some Belgian figures for the sake of comparison. You can download the original presentation on Slideshare.

It goes without saying that I'm extremely sceptical on the South African prospects for 2009 and 2010. As I've written many times before, from Q2 2009 you'll be able to buy into unseen real estate bargains in South Africa. The prices will further plummet and the South African rand will remain low. It's hard to predict however when the uptake will then happen. Although the prospects of Africa as a continent are not at all bad; South Africa is really structurally ill and it will take a while to heal.

As to my biggest worry: the freefloat currency mess, which was my main concern as to the Brazilian Economy in a short term, the Real moved back to pre-crisis patterns. I wrote extensively end September and beginning October how unique the chance was to buy into Reals. The BRL is now again in the 0,35 - 0,375 bracket against to the EU; which is still sound enogh to buy into. When the Reals would move again up above 0,375 to the Euro, I would gold my horses. When the currency would leave that level however, the Banco Central will probably level off the selic intrest rate somewhat. Personally I hope however that move will be taken later than sooner.

Any opinions, input or considerations on the state of the economy in Brazil and South Africa? -

Oct 27 2008

I wrote last weekend on the currency crisis and its impact which is seriously underestimated. Today again the currency pegs are being tested; it recalls the collapse of the Exchange Rate Mechanism in 1992.

-

Oct 25 2008

Yesterday Paul Krugman was on Charlie Rose; the man deserved the noble price for his analysis of trade patterns and location of economic activity.

This weekend all Belgian newspapers are boasting "Belgium consumers don't care for the crisis, they keep shopping". Sometimes I wonder if the newspapers are directed by politicians to soothen us and make sure we don't have a clue of the doom which will fall over Europe and especially Belgium.

The Los Angeles Times published a list of countries and the % their stock index fell with regard to the peak:

Rusia: - 73,2%

Vietnam: -70,5%

China: -69,8%

Hong Kong: -60,1%

Turkey: -58,3%

Egypt: -56,9%

Italy: -55,2%

South Korea: -54,5%

The Brazilian Bovespa went down 57,2% from it's top. Take into accout that (1) more than 40% of the Bovespa is represented by Rio Vale Doce (steel) and Petrobras (oil), which are both very big buying opportunities today and (2) that the Brazilian Bovespa was one the strongest performing stock exchange for the last 3 year; which makes the 57,2% fall against peak much more relative.

And as a comparison: the Bel20 fell 59,62% against its 4750 peak; that's more than the Bovespa !

But currently the stock exchange is not worrying me most. What worries me most is the Yen shooting up like a rocket against all currencies. This is the only reason why stocks have been crashing last week: the Japanese carry trade is crashing because of the Yen rocketing up high. I wrote many times on "Peak Credit" the last months and this is what is ruling the planet now: the US cannot take on more debt. But actually, they ARE taking in more debt, not to buy products made in China, Japan or Brazil, rather to fill a massive bottomless pit that the derivate beasts have digged. Nothing is bought or created with all this money.

And both the US and Japan keep sailing the 0% interest rate boat. True, the US is still a little above 1% most of the time, but the will drop the rates below 1% eventually and kill the few last savers in the US.

It is stunning that no one actually undersands what is going on. In July I predicted the Brazilian Real to fall between 20 - 30%; in October I proved right. On October 1st, I wrote that the South African Rand will not raise above 0,085 against the Euro again in the coming year; I was right (and will be right).

At the same time, the central bank of Denmark is RAISING its benchmark lending rate by half a percentage point. I believe this is the right thing to do.

I also believe South Africa should raise its interest rate to 16%, Brazil should keep its current 13,75% Selic rate and the ECB should keep it for at least another year on 4,25%. Actually, if South Africa would drop its interest rate between now and February, the SAR would further tank to unseen dark lows.

But no, Japan will keep lending at 0%, the US will lower its intrest rate below 1%, the ECB will follow. All for the sake of trade and keep their currencies low.

I am 100% against the exchange markets as they are today. The entire floating currency mess is a nightmare and wrong. It is wrong and it will eventually kill the US and Japan in the long run.

As long as this mess is not solved, there is no way global trade can go back to normal. The whole system of free floating currency regimes and the free trade movements need to be burried. The attemps of corporation and nations to run this system has been a total faillure.

And this is why I admire Sarkosy so much recently (and China with him): his call for an international meeting to talk about the Bretton Woods II and the Nixon floating currency is the only way out of this huge mess we are currently in.

But they will not be able to replace the current system, unless the US first stops spending trillions on military domination, etc... The horns of the dilemma are in the US and they will not kill the current system, they will keep it alive, kill many nations (economically) with it and we will all (also and especially Belgium) be trapped until something happens. And, unless Obama really brings change, this will only be the bankrupcy of the US government which will eventually change the world systems in a massive cascade.

Believe me: Bretton Woods II ending the current floating currency regimes and free trade movements is the only structural solution to the current crisis and the mess that's ahead of us. -

Oct 24 2008

After Iceland, the risk of Russia defaulting increased dramatically the last days. I know, Argentina is also on the list, but hasn't Argentina always been on the list? The Brazilian exposure to Brazil is minimal though.

There is actually a rumor that the Russian government is about to devalue the Ruble, hence the massive runs on Russian banks; Russians do remember the 1998 August crisis.

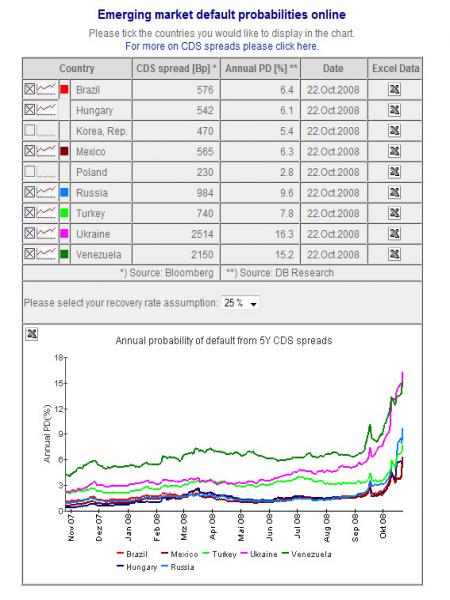

This tool of the Deutsche Bank shows the default probability of Emerging Countries. Brazil is, together with Mexico on the lower hand. Too bad countries like South Africa, Romania or Argentina are not included; anybody? It would also be good to have countries like Belgium, Spain, Italy or France included for the sake of comparison; the findings would be shocking.

-

Oct 23 2008

South African soon-to-be president Zuma is in the US trying the convince investors that he won't be meddling in with the South African Central bank (yet). Only hearing him say "there is no need for panick, it's democracy at work" gives me the shivers. Just 2 hours later, back in SA on SABC2 the chairperson of the South African Finance Comittee falls through his chair while giving a life interview. "Corruption grease" like we call it.

Meanwile, the Zuma Saga continues and that is less funny. -

Oct 22 2008

Nouriel Roubini was on Charlie Rose yesterday, you can't miss the video below. I've been a fan of Roubini since I read this interview in the New York Times in 2006. We've been a subcriber of RGE Monitor ever since. Personally I believe nominating the man as Treasury Secretary could be the best the US (and the world) could wish for at this stage, but I realize this is idle hope at times when the US is swinging on the "Palin factor".

In times like these, one notices that Belgian mainstream media cannot provide a real opinion; they can barely replicate uncoherent threads from abroad; I prefer insights which lead to foresight. One need to turn to Charlie Rose, The Frontline or Bill Moyers to get mainstream news which is worth the name.

Example: the Brazilian crash of '98, anybody? Frontline will refresh your mind in a blink of an eye; and you'll understand immediately why Brazil is harnessed against the current crisis; they have their "lessons learned" still top of mind. -

Oct 13 2008

Remember my post in which I pointed to the increasing interest of America and Russia in Brazil since Brazil discovered its new oil and gas reserves?

Well, today Russian Gazprom announced they are opening their first Brazilian office in Rio, remember the Memorandum of Understanding they signed in 2007. -

Oct 11 2008

The degree of denial on the economical tundra that lais ahead of us is truly mindblowing. To a big degree I blame the mainstream press for this. Like I wrote many times before the Belgian mainstream press (including De tijd, De Morgen and especially the VRT) all fail to give real analysis of what is happening and especially of what's ahead; vox populi indeed. While I have been predictint doom since mid 2007 all of them have been writing until last August that Europe is well shielded and that recession in the US was highly unlikely. Real estate prices were still going up and Belgian real estate would very much unlikely ever go down.

As if everything will soon be OK again? I can't help picturing Willie Coyote still "hanging" in the air, pondering what is happening just seconds before he falls down.

Get real or go home !

Look around you, the impact of this Tornado on 'real life' is hitting shores and the storm is here to stay, for many years.

Luckily some people do read the relevant news sources, Vincent Touquet is one of them, he just beamed me the below excellent presentation of Sequoia: This is not going to be a V-shaped recession: recovery will be long and hard. -

Oct 6 2008

"Keating economic: John Mc Cain & the Financial Crisis": one of the best documentaries of the Obama's campaign.

I just fear this is not a donut for the average America, Palin swallows easier.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...