I don't fully agree that "the banks" are the main culprits. Eventually "the system" is too blame and the systems that is our governments and ourselves.

Many people fail to understand the very definition of money. When I point people to the crashing stock exchanges, people running for their money on the banks, etc... people keep asking me the question "and where is all that money then going to?".

Well... that money didn't existed in the first place. That is the core of the problem of this crisis: PEAK CREDIT. I've written a lot on this phenomenon and people fail to understand it.

It is so simple: the "wealth" that you think you own by adding up (1) your house or apartment (2) your pension fund (3) your stocks and on which you base your "lifestyle", spending pattern and buying behaviour is not real in a fact that there is no money to back it up. For the simple reason that the balance sheet of the world is not matching: there are endlessly more debts than assets, even at the previously inflated values.

The below video illustrates the phenomenon perfectly.

The question that the world is now facing: how do you move your 'presumed wealth' around so that you can preserve most of it? And trust me, look beyond borders when you ask yourselve that questions.

Which currencies do you trust now that the US dollar's supremacy as the world's reserve currency is approaching? Do you want cash under your matress or do you prefer gold? Real estate is a safe gard asset? In which country is it the safest? etc... etc...

What central bankers need to do is abolish fractional reserve lending and ideally return to currencies backed by hard assets. This would be a disastor for the US, they prefer short term actions and try to force liquidity into the system to spur more lending. Such actions can no longer work because the problem is too much lending already. We have overcapacity of everything in Belgium: housing, commercial real estate, restaurants, debts,...

Peak credit: the biggest global credit boom in history is now over !

Emerging South

The world upside down.

-

Oct 6 2008

-

Oct 5 2008

Americans still don’t have a clue what the consequences are of voting the bailout bill.

The current financial crisis is not what counts; the upcoming recession is not what counts. Eventually, the G7 all want to get ‘back to the old’. Well, the old will not come back, ever; that is what counts. The G7 simply cannot figure out what is going on themselves. Just look to Europe, they are screaming for a cheap Euro against the dollar. Of course, everyone wants their currency to be weak against the dollar, so that they can flood the US with imports. Just look at what Japan did the last years, keep the Yuan cheap against the dollar and create a huge trade surplus. Also Europe wants this status quo to continue. BUT IT CANNOT.

There is no way this can continue. All the Europeans are hoping the dollar can be talked up. It is simply absurd that the dollar rises just because Paulson announces the bailout plan; as if his words would contain some magic secret spell. It is a very simple rocksolid rule of economics that any country running huge trade deficits all the time will have a weakening currency. Expect some huge volatility in exchange rates for the coming weeks and months, but eventually the hocus-pocus will fail and the dollar will crash.

But don’t be fooled, the problem isn’t the value of the euro (against the dollar). The problem isn’t the value of the Yuan and even not the value of the Yen. The problem is the wild spending of the American Empire. The repairs that are needed will change the whole economic system and the world’s political systems. It’s simple: the world has a trade surplus with the US. This surplus has been growing since 1968. In 1968, the trade deficit of the US was 5 billion US$. Then it was over20 billion US$ each year in the 1970's then in the 1980's, it rose to over 50 billion US$ a year and then in the 1990's, it climbed ever steeper to 100 billion US$ a year and more and then...today, it is nearly a trillion US$ a year.

A DEFICIT OF A TRILLION US$ A YEAR !!

A number completely outside the laws of equal trade which will eventually crash the hocus-pocus and drive the dollar down and down and change the powers in this world drastically. You can feel the ground trembling as the volcano is setting to explode; it will happen in an eyeblink. The US is preparing for tax cuts and dropping interest rates. This is insane, it will only speeden up the explosion of the volcano. People seem to forget that China has more sovereign wealth than anyone on earth and unlike the second sovereign wealth nation, Japan, China doesn't have much sovereign debt. After the US, Japan is number 2 in soveriegn debt. Indeed, its sovereign debts are 9 times greater than Japan's Forex reserves while China's is 4 times smaller than their Forex reserves!

This simply means that China has a grip on the world banking systems for the simple reason that China IS the bank. And now the US would have to ask the Chinese to make their currency the strongest on earth while the US pretends to be the number 1 empire? China will only rise their currency when it can forma strong alliance with Japan, when Taiwan is reintegrated with China, when Korea is re-united and in a military/economical alliance with China, etc… But Japan won’t agree with this path, Japan dragged Asia into World War II and it will do it again. Meanwhile Europe is imitating Japan, Russia and China and swallowing all the freshly printed dollars in the hoop to keep pushing the rate of the dollar up. But the end is in sight, the US customer can simply not swallow more debt and the US industry is dying. This brings us to the conclusion of the current events: all the actions taken by the European, Japanese and US nations are driving us into the very problems we all claim, we want fixed. Which means we want this mess to continue and make the US look strong even when it dies. This is exactly what the bailout plan is about. Europe wants a strong dollar, no matter what! Meanwhile we tend to forget that for decades Europe joined the US in destroying Russia. After promising Russia, we wouldn't expand the EU, we did. After promises we wouldn't expand NATO, we did. Now we are trying to park ballistic missiles right on Russia's front doorsteps! Only this time, Europe is at the mercy of Russia. Europe has no energy and depends on Russia like a baby who needs its milk.

Do not underestimate the “new Russia” that is standing up. Anyone who follows the news in Brazil (which already had 12,5 billion barrels of oil reserves in the ground) is aware that Brazilian Petrobras has discovered significant deposits (up to 70 billion barrels) of oil plus natural gas off the coast of Brazil. This is major news for Brazil. The country its electricity is already for more than 90% auto-sufficient on hydro-electric, more than 40% of its cars already drive on ethanol and with these new gas and oil finds, the country could become completely energy-sufficient for the next century and beyond. Until…. the Americans decided to re-establish the US Navy 4th fleet and put its eyes on Brazil’s oil early September. After which Brazil reacted and is currently negotiation with France to build a nuclear-powered submarine to protect its oil. Brazil will also expand its Navy’s surface fleet and buy several more nuclear submarines to keep the Yanks away. But, eventually it will be Russia ruling the show, shortly after the US set off to Latin America, the Russians also set sea.

The country its electricity is already for more than 90% auto-sufficient on hydro-electric, more than 40% of its cars already drive on ethanol and with these new gas and oil finds, the country could become completely energy-sufficient for the next century and beyond. Until…. the Americans decided to re-establish the US Navy 4th fleet and put its eyes on Brazil’s oil early September. After which Brazil reacted and is currently negotiation with France to build a nuclear-powered submarine to protect its oil. Brazil will also expand its Navy’s surface fleet and buy several more nuclear submarines to keep the Yanks away. But, eventually it will be Russia ruling the show, shortly after the US set off to Latin America, the Russians also set sea.

The world will never be the same. -

Oct 5 2008

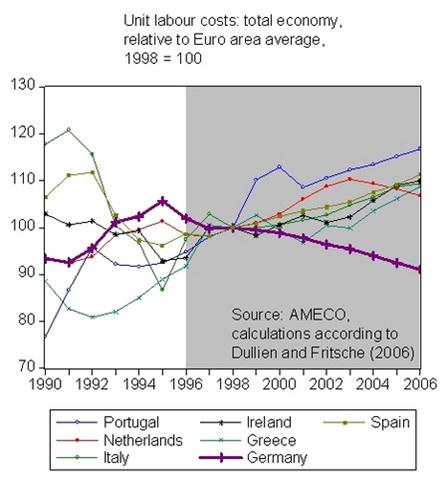

For decades, Germany was well known as a country with a relatively high productivity growth.

But the picture has changed: Germany’s productivity growth fell from 1,9% in 1995-2000 tot 1,4% for the period 2001-2006, the latter is slightly above the average of the overall performance of the Eurozone.

I don’t have the productivity rates of Belgium for those two periods, if anyone has them, please send them to me. Yet, I’m quite convinced the trend will be in the same line.

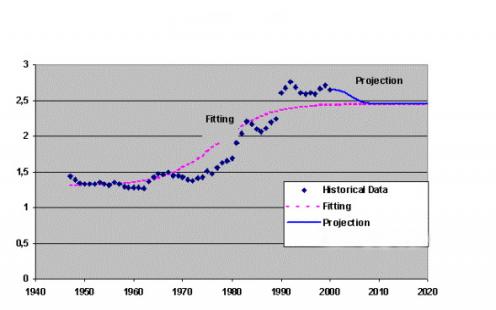

The German productivity growth trend is opposite to the Brazilian one. Brazil’s productivity growth went up from 1,5% in the 80s to 2,5% currently. That last figure has remained relatively stable for the last 2 decades.

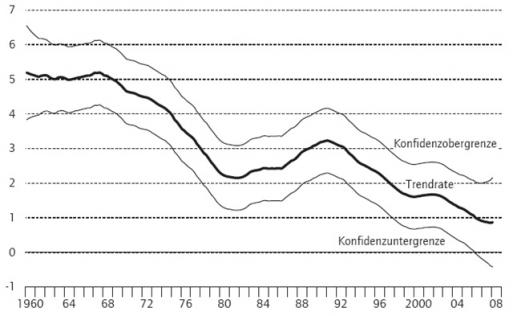

The German productivity slowdown is, however, not only pronounced in an international perspective but also in historical perspective. Productivity growth was at rates of 2.5 per cent on average over 1985-1990 and on 2.9 per cent over 1990-1995. Of course, the German re-unification in itself boosted the growth rates. The decline from 2.5 to 1.4 per cent over 15 years, however, is alarming. The last years the superficial European financial newssources have been blinding us with the extraordinary German export performance. However, their competitiveness was mainly driven by massive wage restraints and is not at all due to productivity gains. The picture below is a little bit older but nevertheless intuitive. The bold pink magenta line is Germany...

To all the people going on strike tomorrow in Belgium: look at the above charts and ask yourselves the question: how can Belgium as a country remain competitive? Most of the Belgian policies for expanding new sectors and stimulating innovation haven’t really delivered substantial results. Personally I don’t believe Europe will ever have longterm productivity gains above 2% again, in fact, I believe we might be in for decades of productivity gains well below 1,5%. This means that, just like Germany did, the only way for Belgium to remain competitive is massive wage restraints. -

Sep 27 2008

I immensely enjoyed this debate on CNBC yesterday and fully second the opinion of Chris Whalen.

If this bailout bill will be voted, the stock markets will rally for a few days, but eventually liquidity will dry up even more, volatility will stay high and financial assets are going to suffer as the crisis continues to unfold. The bailout plan is unlikely to work and the global economy will take the hit; don't underestimate the force of recession knocking on the door. Personally I can't understand people who think we'll soon have new highs again on EU and US stock exchange; this is out of the question for a very very long time. Equities are still priced high and economically the world is going into a slump. I think the US economy is much weaker than what most think and I believe the trade and current account deficit to continue to contract. And the people counting on foreign reserves of resource-rich countries: these are also likely to dry up. Sovereign wealth funds will focus on supporting their own markets. I truly hope this bailout plan won't make it, although I believe it'll be idle hope.

And I'm not the only one, more than 150 prominent U.S. economists, including three Nobel Prize winners, urged Congress to hold off on passing a $700 billion financial market rescue plan until it can be studied more closely.

The next emergency measure might be that that Americans are not allowed to buy foreign currency and transfer money overseas, and the one after that could be not permitting Americans to buy gold and so on and so forth… It creates even more uncertainty in the market place when you continually change the rules. -

Sep 26 2008

It's no secrete I think that the proposed 700 billion US$ proposal of Paulson, backed by Bernanke is suicidal. I am convinced Paulson's plan wll put the US further into a fiscal abyss. Not that I mind so much, only will they pull the world and especially Europe with them in their fall. Has anybody of you had a close look to the productivity increase rates in Germany or Belgium? Since the mid 80s productivity growth has been constantly falling. This is structurally and the effect of it combined with the current financial crisis, which is about to stay for a long time, will be disastrous.

Have a look to thisexcellent speech of Marcy Kaptur of Ohio speaching at congress and make your own call on the future.

Taxpayers did not get their fair share of the upside, but they are getting all of the downside and a huge IOU. While Wall Street is made whole, the folks on Main Street are getting the bill. What has mama given us here? Are Mr. Bernanke and Mr. Paulson giving them any bet on the upside? They're not even helping them on the downside. I feel sorry for our country, I feel sorry for this Congress, that we can't do a better job of standing up for the people today. Where's the Federal Reserve, Where's the Treasury? Why do they only help the rich people? What about the rest of the people who have to work for a living? Wake Up America. Wake Up America. Contact your member of Congress. -

Sep 20 2008

South African's president Thao Mbeki was 'fired' today. I've written a lot on the powergames within the ANC, but who would have thought the ANC would eventually kick Mbeki out a year before the elections?

The United Democratic Movement (UDM) has condemned the manner in which the ANC recalled President Thabo Mbeki on Saturday, describing it as "an act of political barbarity."

"To remove the head of state like this is an act of political barbarity that threatens to plunge the country into anarchy," Bantu Holomisa said in a statement today. The move threatens to destabilise the country, especially if other cabinet ministers act on threats to resign in solidarity with the president. Several key figures, including the deputy president, Phumzile Mlambo-Ngcuka, have indicated they will follow Mbeki. If Finance Minister Trevor Manuel will follow, I will personally get very worried on the economical consequences.

More in this excellent article in the South African Mail & Guardian.

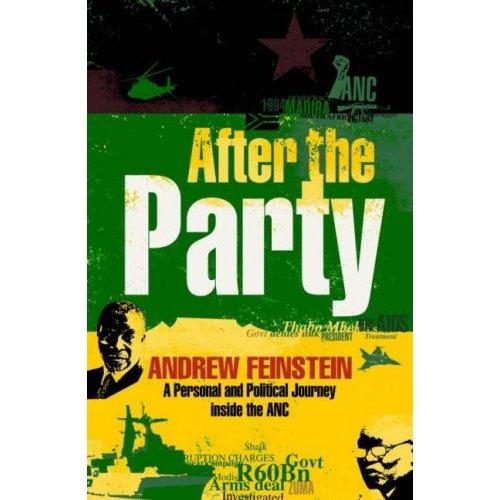

Early september I bought Andrew Feinstein's book "After the party" in Johannesburg. Andrew Feinstein was an ANC Member of Parliament and the former African National Congress leader of Parliament's public accounts watchdog Scopa, resigned when the party moved to curtail investigations into the arms deal. His book After the Party gives a very well documented insider's view of the process. A true must-read; you can find it on Amazon UK.

After reading the book, you'll understand why the 'dismissal' of Mbeki is a very, very worrying event for South African's fragile democracy.

-

Sep 2 2008

I just received the news that Chavez and Mbeki are signing a major, far-stretching energy deal (hat-tip to Vincent). I already wrote back in december that I suspect SA's next president Zuma to heavily incline to the extreme leftist Chavez. This is a very bad early signal of what will come under Zuma's command. Rest asssured the US and Europe are closely watching this evolution and surely not liking it.

"September 2, 2008 Venezuelan President Hugo Chavez and South African President Thabo Mbeki are expected to sign a strategic energy agreement during a two-day visit by Chavez to South Africa that began Sept. 1, South African commercial daily Business Day reported Sept. 2. Under the deal, South African energy firm PetroSA reportedly will receive oil from Venezuelan state firm Petroleos de Venezuela while exploring for natural gas off Venezuela and possibly acquiring oil production facilities in the country. PetroSA is also expected to promote the adoption of gas-to-liquid technology in Latin America." -

Aug 30 2008

Excellent articles in South African's Financial 24 and The Financial Times:

Johannesburg - Finance Minister Trevor Manuel said on Tuesday evening that South Africans were not adequately saving for tomorrow and preferred instead to consume in a US-like manner. He said households were highly indebted and "South Africa’s next government will have to depart radically from a decade of conservative economic policy if it is to defuse a “ticking bomb” of poverty, unemployment and crime that threatens to blow a hole in the investment climate, according to an ally of Jacob Zuma, the frontrunner to become president next year".

Clear language !

In the Financial times:

...However, Trevor Manuel, the finance minister, later warned that abandoning inflation targeting would hurt “the poor and needy” most, saying a far greater problem was rampant middle-class borrowing to fund “sporty cars [and] huge houses”...

...Mr Zuma and his backers have cultivated a base among the majority of South Africans who feel that a decade of fiscal restraint under Thabo Mbeki, the outgoing president, benefited foreign investors and a small black middle class but did little to raise living standards for the poor....

...Expectations of change are reaching astronomical levels...

...With a current account deficit now at 9 per cent of gross domestic product, South Africa is vulnerable to shifts in investor sentiment...

...Public works “on a mass scale” could in part be funded by lowering incentives for investors and a “maybe painful” adjustment to the corporate tax system... -

Aug 28 2008

Just dropping in on Bloomberg: South African inflation raises to 12,9% in July, coming from 11,6% in June. This is the fastest growth since the CPIX inflation index was introduces in 1998. By way of comparison, the comparable Brazilian IGPM inflation index fell in July with 0,32% to 6,32%; that less than half the South African inflation in July.

Yet, both countries have today the exact same growth expectations for 2008: 4,8%.

Remember the definition of inflation: “a net expansion of money supply and credit”. While Brazil is enjoying a healthy economical growth with deficits after years of tight monetary policies, South Africans can't hold their horses to get again 'cheap credit'. I only don't like Lula announcing that he will increase government spending by 13% in 2009; yes that is a pre-election year. Yet don't expect things to be better in South African's pre-election year; Zuma can learn wise lessons from Lula. -

Aug 27 2008

The last 2 weeks I've been hearing more people around me claiming that by Q1 2009 things will brighten up economically wise. The only substance for that claim I've heard sofar is that they believe inflation will go down and as thus the economy will pick up again.

First of all: credit will remain tight, for long times ahead, just read that Libor signals tigther credit as banks balk at lendingor read what the IMF is saying :

A towering grizzly bear guards the doorway to the Federal Reserve's annual policy retreat in this Teton Mountain resort, serving a reminder to central bankers of the battle to sooth the credit crunch. "This turmoil is not going to go away quickly and will require serious efforts to overcome it," a top official of the International Monetary Fund, John Lipsky, told Reuters.

There's the Russian clouds coming over and another piece of the puzzle to consider is China's Olympic Sized Bust. The opening ceremonies were fantastic, but where was the payback? In a command economy there does not have to be a payback. Appearances are often more important than realty, and deviations from plans are simply not tolerated. Things look extremely troubled in Chine, the China hink thank expects 10,3% growth in Q3, personally I can hardly believe this growth is sustainable into 2009. Just look at the environmental disasters there. China's growth story is stopping.

I will keep repeating myself: don't expect thing togo back to 'normal', the 'old times' are not coming back, cheap credit is over, foregood. Once upon a time, central banks had bank vaults. In these vaults were blocks of gold. This was used as the basis of all banking. In addition, all the member banks had to collect something we called 'savings'. This was also called 'liabilities' by the bankers since they had to pay these savers 'interest'. The interesting thing about interest is, this money has to be relent at a higher rate so the bankers could then collect interest, too. And they were allowed to do this on a reserve of savings of less than 10%. Even with the central bankers controlling this reserve requirement, the member banks often ended up in the ditch, overextending loans too much. This is because they love collecting interest rather than paying interest! The investment bankers decided to play this game with less than 1% reserves. To do this, they needed the Bank of Japan's 0% lending. At 0%, a bank can lend forever. US banks sit on virtually no reserves while Asian banks sit on mega-reserves. And this is hyper-unbalanced. And mirrors unbalanced trade relationships.Now, the central bankers no longer hold more and more gold as they lend. They don't hold more and more capitalist profits. Or more and more worker's savings. The FAKE interest rates are responsible for this situation! Since all the central banks set rates below the rate of real inflation, everyone is putting their money into various instruments that THEY HOPE, HOPE will grow faster than the other nasty hag, Inflation. But Inflation gets stronger and bigger, the faster money grows! The more everyone seeks a greater return outside of the banks, the more powerful Inflation is.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...