I picked up the South African Times in the airport on Friday, the cover read:

"Six million can't pay their debt":

Experts told The Times that the economic “perfect storm” — high inflation, including food and fuel, and the resultant interest rate hikes — have driven six million South Africans to the brink.

Rajeen Devpruth, manager of statistics and research at the National Credit Regulator, said that by the end of last year, 6.3 million South Africans had “impaired credit records”, which means their payments were more than three months in arrears or judgment had been obtained against them for outstanding payments.

That’s half of the 13 306 000 South Africans currently employed, according to the latest Labour Force Survey in September 2007.

I've been predicting this situation for over 18 months now. And still today, while the South African government is looking for thousands extra debt counselors, some peopleare still no realising the extent of the crisis and pretending the dip will be over in a few months from here. Think again !

Last week, Johann Rupert, chairperson of SA Remgro told to his shareholders that the South African recession could last another 5 to 10 years. Even Mbeki is extremely sceptical about South African Trade.

The signals are clear: South African retailers Woolworths and Truworths forecast a tough year ahead, only Massmart can keep its nose above the water with its low-cost stores.

Some people will state that the June-July 2010 Fifa World Cup will save the day. I have a different view: the Fifa World Cup is a huge risk for South Africa. When you visit Johannesburg, Port Elizabeth and Cape Town, you will understand that FIFA executives have expressed concern over the planning, organisation and pace of South African's preparations. And even if the World Cup will take place in South Africa, it will be a very disappointing event with the Chinese Olympics in the back of our heads. Also, June-July is winter in South Africa, not an ideal period to receive tourists. And on top of that, June 2010 willbe exactly one year after the elections.

To sum it up, next to the economical crisis, the country is also facing the following challenges:

Emerging South

The world upside down.

-

Aug 24 2008

-

Aug 15 2008

Europe had a quarter of negative growth, another quarter like this and the Euro enters its first recession, which is likely to happen.

While the Japanese Real Estate market is crashing, the smarter US analysts are warning that there are HUGE shadow inventories of US foreclosed homes still to be released on the market; and meanwhile Greenspan wants you to believe that the US real estate market will stabalise from 2009 on... right. Expect this graph to go further downwards, drastically.

Today Chief Investment Strategist Richard Bernstein of Merrill Lynch stated:

"We believe that the investors seriously underestimate the extents of the credit crisis and the consequences of the deflation which will follow now".

I have written for the past half year on the deflation storms which are about to hit Europe and the United States.

Meanwhile in South Africa, Standard Bank has to rely on its offshore business to hit targets:

"Johannesburg - Standard Bank would offset the effects of lower-than-expected economic growth rate in South Africa with profits from its offshore businesses in Nigeria and China. One worrying sign for Standard Bank was the increasing problems the company was facing in its card division. The credit loss ratio in card debtors increased from 6.34% to 9.44% indicating that the consumer was becoming increasingly stretched." 9,44% credit loss ratio in amongst card debtors, ouch !! Meanwhile Mboweni decides to not raise interests above the current 12% rate. This is a strategic blunder. Yes, I know, the general tone is that he did good in not raising the rates, because ""… the alarming rate at which cars and houses had been repossessed should be a matter of concern to Mboweni and the MPC. " At the same time inflation keeps skyrocketing and will go from the current 11,6% to 13% by the third quarter. Yet, Mboweni keeps the repo at 12%. Read that again: inflation at 13% with a repo rate of 12%.

At the same time, South African banks are turning into vulture hawks. If you put down a deposit on a property and FNB reassessed your loan and denied you your bond causing you to lose your deposit, FNB says that you should thank them because in actual fact you probably were going to lose a lot more money later on. No, I didn't make this up, it's happening, on a wide scale.

Mboweni claims "``Food and oil price increases continue to cloud the inflation outlook, but there are tentative signs that these pressures may be moderating.'' The wording makes me smile: Food and oil price increases continue to cloud the inflation outlook, but there are tentative signs that these pressures may be moderating.

Well, I think Mboweni is wrong. "Prices will decrease when supply surpasses demand. And that will happen South Africa focuses now on expanding infrastructure and assist its people to be more productive. For this reason the government should now focus on the production side of the economy and increasing skills rather than simply placing money, in the form of social grants, in people's hands. When increased production is attained prices will be constrained, which will eventually also curb inflation." These are not my words, but a literal quote from this article. And the worst is, Mboweni will blind people, inflation will go down…well the CPI will go down…because the government plans to change the measurement of the consumer price index next year. The SA statistics office said on July 1st it will reduce the weighting of food in the CPI, which will lower the inflation rate… artificially (see Bloomberg).

Meanwhile, at the annual Rode conference on property in South Africa today "Johannesburg - House prices are expected to drop by between 10% and 15% in the next 12 months as rising interest rates and tougher credit-granting laws force buyers to tighten their purse strings, a property expert said on Thursday." Prices in Plettenberg Bay are taking a dive and when asked for the reason of selling, 18% of the people mention emigration, this figure is up from 7% 12 months ago.

Standard Bank posted a 7% rise in first-half normalised headline earnings per share (EPS) to 481,8 cents today, but said rising bad debts meant it could not give full-year guidance. When banks come with these messages you better brace yourselve for the storm, especially when you are in real estate business. One of the "saviours" of the housing market is supposed to be the Black Diamonds, the young black professionals who have been spending money like crazy the past few years. Only one problem though, they've been spending borrowed money (mainly via credit and store cards) and getting into a heap of debt, and now that debt is becoming overwhelming, read the details here.

Conclusion:

The monetary loosening of Mboweni worries me; of course it 'could' boost sentiment a little bit on a short term; but it will come at a very, very high price; if you lived in Brazil in the 70s and 90s, you know all about that.

Zimbabwe worries me.

And what worries me most (although there are some opportunities in it for the well connected) is the ongoing land reform in SA.

As I've been saying repeatedly: not just an ordinary global economical blip. -

Aug 14 2008

Mbeki failed again in his mediation role. Tsvangirai "stormed" out of the negotiations brokered by South African President Thabo Mbeki late Wednesday. Reports from Zimbabwe indicate that Mugabe may now be trying to make a deal with a small opposition faction and cut Tsvangirai out altogether, despite Tsvangirai's strong showing during elections earlier this year. Stability is far from being reached.

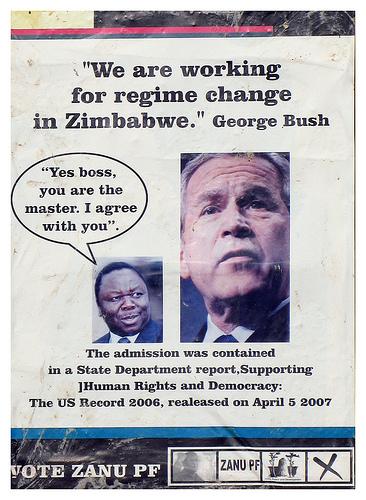

Meanwhile, to keep things on a lighter side this hilarious election propaganda poster from the streets of Harare.

~ picture from Gregor Rohrig who's currently in Zimbabwe -

Aug 13 2008

"Whatever the Central bank does, getting credit is very hard": the title of an excellent article in the Tijd yesterday, proving exactly my repeating point that we are in a deflationary market. Bloomberg also writesthat Money Market is `Plagued' by Libor that the Fed can't reduce, The Wall Street Journal writes that the European banks are tightening lending Standards; just read theJuly 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices and make your own conclusions on the size of the deflationary hurricanes coming your way.

Worse even, the Financial Times wrote that corporate debt default could hit 10%, more defaltion anybody? It's clear the next move of the US Fed will be... down ! Which is crazy of course; savers can then take their money and use it to buy another currency and take advantage of realistic interest rates (like on the Brazilian R$). Aw, that will be prevented by a global plan to prevent ANYONE from saving money. This takes us back to gold. As soon as commodity inflation is gone, then buying gold will be the only way to preserve funds.

Once again, this crisis is not just a cyclical crisis. We had a system for the last sixty years which precipitated the greates debt cycle in history. And now the Americanfed will address the greates deflationary cycle (wake up if you still have the inflation titles on your cornea) with the same remidy which started this crisis in the first place: cheap loans.

With the macro data of the last weeks, it's clear now that the G7 countries (the group of the major advanced economies including US, UK, Japan, Germany, France, Italy and Canada) are already in a recession or close to tipping into one. Other advanced economies or emerging markets (the rest of the Eurozone including Spain. Ireland the the other Euro members; New Zealand, Iceland, Estonia, Latvia and some other South-East Europe economies) are also very close to entering recession.

Yes, that includes Australia, the Australia Reserve Bank just announced it is "shocked" by the severity of the Australian economy slowdown. I previously wrote on Australia, but who would listen then? Associate Professor Steve Keen from the University of Western Sydney wrote last week "Brace youyrselves for recession" and that's exactly what I would recommend you to do.

And yes, meanwhile consumer spending in China and Brasil are still rising; even if inflation remains under control at around 6% in both countries. Yet, both China and Brazil need this growth. For example, a country like China - that even with a growth rate of 10% plus has officially thousands of riots and protests a year - needs to move 15 million poor rural farmers to the modern urban industrial sector with higher wages every year just to maintain the legitimacy of its regime; so for China a growth rate of 6% would be equivalent to a recessionary hard landing. This is why the IMF defines a global recession as a global growth rate below 2.5% as emerging market economies usually grow much faster (6%) than advanced economies where growth averages about 2%.

It now looks like that, by the end of this year or early 2009, the global economy will enter a recession.

And you wonder why the Euro is doomed to keep falling? Simple: Whenever global liquidity tightens relatively speaking, it is very US$ supportive, just watch this interview with Marc Faber.

No, there's no easy solution to this crisis. We will need to understand again to stop believing the fairy tale of debt-leverage into unproductive investments and this will require a massive change of political structures, financial intermediation channels, savings and consumption habits, and economic incentives which challenge virtually every assumption made by at least two generations. Our kids will never forgive us for our naive debt-leveraged way of doing business. -

Aug 10 2008

We had a BBQ in Belgium with a bunch of Brazilian friends; it's always great to have Brasilian friends over and get some Carioca vibes in the house.

We had a BBQ in Belgium with a bunch of Brazilian friends; it's always great to have Brasilian friends over and get some Carioca vibes in the house.

A popular conversation topic amongst the girls is the problems they have in finding clothes in Europe, that is in Belgium and London. I get what they mean. Just get out on an average Saturday in De Veldstraat and take pictures of girls and women in the street and do the same on a average Saturday in Ipanema. Sure, one cannot speak in average terms, of course, (some) Belgian girls have the taste to make your jaws hurt when you're in a Belgian club.

My conclusion of this heated debate is that the Belgian fashion retail is completely different than the Brasilian one. In Belgium 80% of the clothes sold comes of 20% manufacturers, the big 'all the same mass'. In Brasil the number of small brands are much more present on the streets. The other opinion I have is that in Europe many 'interesting' fashion labels have flasgship shops in Paris, Milan and other 'fashionista towns' and distribute heavily on the Web. I've become a big fan of shopping on Asos, Cult, Frontline and Asos myself.

And am I the only one noticing that Europe is being influenced by Carioca fashion? Lorenz with his shirt out of his trousers on Kanaal Z when being interviewed is just one striking example?

Personally I am more keen on Curitiba Fashion trends (when it comes to myself)and when it comes to women, I have a slight preference for the Paulista catch; yes, this and that style.

But Carioca style isless complicated, and as sexy (please, just wipe out the men in Rio) To my happy susprise, German Brandneu was inspired by Rio and made inspired it's whole collection and catalogue on it. Check out their Guide, they made it nearly as appealing as the "Visit Rio" blog.

Here's their complete catalogue, (Carioca) girls, what's wrong with:

- The Seven7 stretch jeans on page 34?

- The Strenesse combo on page 56 (grey dress and pink tee)

- The Adidas Polokleid on page 68?

- The Joop pants on page 72?

- The Joop leather jacket on page 74?

- The Oui Set dress on page 75?

-

Aug 3 2008

The Belgian employers are starting to panick, and so they should. Unfortunately the Belgian politicians are on holiday to prepare for the next sequal of their muppets show. It has been more than 18 months now that I have been predicting doom in the US and Europe.

And look to the press of last weekend:

British businesses are running out of cash (do you feel that deflation breeze in your neck?), and the British manufacturing output shrinks the most since one decade. If you think things are on their worst now and real estate and stock prices will soon go up again, you need a wake-up call.

The same for those people who think this is the time to buy real estate in the US. The US is full of ghost towns where developers are leaving their projects for what they are and they are no signs the houses prices are hitting bottoms, even if the gains if the last 4 years are wiped away with the price decrease that already took place.

And meanwhile in Brazil,FIRJAN (the Federation of industries of Rio de Janeiro) published its yearly report of the 100 fastest growing and most developed cities in Brazil. The list contains 5.559 cities and in the top 100 only cities with less than 300.000 inhabitents are featured, with the exception of Curitiba and Vitoria. Only 2 exceptions of cities in the top 100 which are at the sea: Vitoria and Niteroi. And in the group of top 100 cities, 87 cities are in the Sao Paulo state. Read more here. -

Aug 3 2008

Some people are hoping Zuma miught become a copy of what Lula meant to Brazil, so do I. Only I fear it's idle hope. There was the laughable way his rape case was filed and let's hope the currently ongoing corruption charges, which involves arm dealing doesn't go the same route. But then again, has Mbeki been that good to South Africa?

Some people are hoping Zuma miught become a copy of what Lula meant to Brazil, so do I. Only I fear it's idle hope. There was the laughable way his rape case was filed and let's hope the currently ongoing corruption charges, which involves arm dealing doesn't go the same route. But then again, has Mbeki been that good to South Africa?

This week, the strategy of his lawyers took a major knock when the Constitutional Court rejected Zuma’s appeal against the Supreme Court of Appeal’s decision to allow the state to use 93000 documents it had seized in the August 2005 raids on his homes and offices and those of his lawyer, Michael Hulley. This is good news ! Zuma's party, the ANC is now lodging to have the case thrown out as amiuci curiae (friends of the court). Meanwhile they try every delaying tactic and consider constitutional changes which would prevent a sitting prsident from facing criminal charges.

Tomorrow is an important day for South Africa. The 'new' Africa deserves a Zuma standing trial. I'm sceptical however such will happen.

Monday update: Zuma entered court, video on CNN. -

Jul 31 2008

In South Africa, sellers are battling to recover their purchase prices as this article in businessday states. Also the agents are struggling for survivel and unfailingly honest and willing to co-operate.The New York Times follows the tone of voice in an article today on South African real estate property:

"Research shows an estimated 40 percent fewer mortgages were issued in the past 12 months over the previous period the year before, according to Colliers International. Although list prices have not come down, sellers are accepting offers well below asking. Residential sales prices across all categories have shown their biggest decline in 15 years — except for the extreme upper levels of the market, Ms. Uys said."

A buyers market indeed. Still, it's too early; wait until Q2 2009 to make your move. Inflation in SA went up to 11,6% in June and youn can expect a prime rate hike to above 16% in June; that'll put the knife on the throat of a lot of people.

Meanwhile Alexei Barriouevo has an excellent article in the same New York Times on the Brazilian Economy:

Brazil, South America's largest economy, is finally poised to realize its long-anticipated potential as a global player, economists say, as the country rides its biggest economic expansion in three decades. That growth is being felt in nearly all parts of the economy, creating a new class of super rich even as people like Sousa lift themselves into an expanding middle class. Still, the momentum of its economic expansion is expected to last. As the United States and parts of Europe struggle with recession and the fallout from housing crises, Brazil's economy shows few of the vulnerabilities of other emerging powers. It has greatly diversified its industrial base, has massive potential to expand a booming agricultural sector into virgin fields and holds a tremendous pool of untapped natural resources. New oil discoveries will thrust Brazil into the ranks of the global oil powers within the next decade. Yet while exports of commodities like oil and agricultural goods have driven much of its recent growth, Brazil is less and less dependent on them, economists say, having the advantage of a huge domestic market — 185 million people — that has grown wealthier with the success of people like Sousa.

Two countries full of potential, if you make the right moves, at the right time; seldomly we've lived such interesting complex times. -

Jul 29 2008

In the Belgian news today: new apartments in Belgium drop 15% in price by the end of 2008.

Only 2 weeks ago De Morgen was still wirting that Belgian real estate prices were growing fastest in Europe, or how deceivingly inaccurate the Belgian mainstream press is.

I’ve been writing for the last months about the deflationary hurricane that is coming towards Europe, the United States and even South Africa.

Surprised to read deflation, while all the newspapers and politicians are screaming inflation?

Let’s define inflation; dictionary.com defines inflation as:

“A persistent increase in the level of consumer prices or a persistent decline in the purchasing power of money, caused by an increase in available currency and credit beyond the proportion of available goods and services.”

Mind the "caused by". The problem with these “because of” definitions is that you don’t know why prices are rising or falling. Example: is there any way to decide what % of the increase in the price of oil (or any other product) was "caused by an increase in available currency and credit beyond the proportion of available goods and services"? The answer is no, of course.

The proper economical definition of inflation is:

“a net expansion of money supply and credit”, while deflation is the opposite.

In this perspective, the Brazilian inflation of 6,2% (projected yearend inflation) is a real inflation; the credit expansion is there and the Brazilian central bank is cooling it off by crunching the credit supply with higher interest rates.

Still, over the last years of growth, credit has remained much crunched in Brazil, the country still has the highest real interest rate in the world, after Turkey. And this is a good thing. This in sharp contrast the South African credit glut of the last decade. And this is where Brazil and South Africa diverge, a lot. The real interest rate (Money market interest rate – inflation) remains relatively stable in Brazil. In South Africa the real interest rate is increasing, rapidly. Which means that the deflation hurricanes are hitting the South African borders. In South Africa, as in the US, the weak South African Rand and US dollar have been masking deflation, this in sharp contract with Brazil, where the Real has been one (if not the) best performing currency of the last years, even at the moment of writing this article.

Everyone has been screaming ‘peak oil’ and ‘bond bubbles’ in South Africa, Europe and the US, while missing the more important point of the deflationary forces of foreclosures, bankruptcies and massive write downs in credits.

Exaggerating? You wish, quoting Standard Bank in South Africa -dated end June-:

"Lower house prices are expected as the credit crunch starts to have an effect, according to South Africa's Standard Bank. In 2005 South Africa was one of the fastest growing property markets in the world. But now analysts believe recent overvaluation means it cannot go unaffected by global economic conditions. We anticipate a large decline in demand for residential property as we enter a period of national house price deflation which we see as a correction in house prices to more plausible levels", a spokesman said.

I have been writing since September 2007 on this upcoming financial change, Q4 2007 was the first quarter decline of asset backed securities in the US. Since then more than 225 billion US$ went from the asset sheets into the loan tables of US banks.

And guess what, this massive contraction hasn’t stopped yet, we now have a year-on-year decline curve and I don’t expect to see this change any soon. This means that the credit crunch is not coming to an end either.

Today in South Africa, lenders are paying well above market rates to lend money. Most South African banks are offering 250 basis points or more above treasury rates. On a percentage basis, this is an enormous spread. And expect this spread to widen further. In a credit crunch, junk yields should rise, and they are (in SA, the US and starting in EU); in a credit crunch lending standards will tighten, and they are. In a credit crunch lenders will say not to almost everyone and they are (certainly in SA). Expect the South African bank to do another rate hike this august, which will bring the SA prime interest rate above 16%. When you read this excellent article on the 3,5 Income versus property price (hat tip, Vincent), you understand that this next rate hike will kick start a true deflationary spiral effect on SA real estate prices. The deflationary spiral in SA (and Europe) is only starting, Q3 2009 is the moment to go in and buy. Until then: hold in to your Money Market accounts or rent out your apartments/houses. In Europe the renting road can be bumpy though. Look to Belgium: the politicians are well aware of the flood of people who will be turning to the rental market and the lobby machine to make sure rental prices remain contained is already white hot.

Why would Brazil be any different, you ask? I’ve written extensively on the macro economical differences of Brazil. Never forget the country in itself is a huge internal market, in contrast to South Africa. Just read this excellent Reuters article of last weekend on Brazilian millionaires. True, a commodity crash would impact Brazil. Yet, today only 16% of the GDP of the country depends of exports.

But all this of a lesser importance compared to the fact that Brazil only has a real estate financing of 2% of its GDP.

In Belgium and the US, this figure is today more than 70% of the GDP and in South Africa the figure must be also well above 50%.

This is where Brazil differs from South Africa, Europe and the US: the country knows what ‘peak credit’ is, whereas in Europe, the US and South Africa we have lived in an insane ‘leveraged world’ during the last decades and this world is now coming to an end. Don’t think this is just another cyclical crisis we are having; this is ‘peak credit’, worse than ‘peak oil’. This is why a real estate crisis is far less plausible in Brazil, only a tiny amount of the GDP of the country has been based on ‘leveraged real estate’ which means that a contraction of the money supply would not result in a deflation.

The uncertainty factor of Brazil is of a different kind: all the above leads to the Brazilian Real becoming so strong that the Brazilian government might decide to devaluate the currency and for example peg it to a basket of Asian currencies. Anyway, the effect would never be of such a magnitude of the 40% devaluation of the South African Rand against the Euro since February 2006. If you foresee, you can act. -

Jul 13 2008

The financial crisis enters the phase where the credit implosion will become visible. More than a year I've been warning now for the consequences of the levels of credit in Europe and the US.

Today more than a third (41%) of US workers are cutting back on utilities, nearly half have reduced food purchases (48.5%) and a large percentage are buying less clothing. The national survey of US workers, conducted May 12-14, 2008, also found that younger workers (between the ages of 18 to 29) are being hit the hardest by the economy and are the most desperate about their economic future. More than one third (34.3%) of young American workers say their financial situation has caused them to “feel hopelessness or despair about their economic future.” That compares with 28.8% of workers age 30 to 49, 23.5% of workers 50-64 and 17.9% of workers 65 or older. Nearly a third (31.4%) of workers report being occasionally kept awake at night because they worry they will not meet housing payments, credit cards, or other personal expenses, 36.8% of whom were between the ages of 18 and 29.

Meanwhile peak credit also reached Australia, where more than 50% of the Australian homes are loosing value. The situation is of such a kind that a wave of public school students is migrating to the public system; their parents simply can't afford private school any longer.

Meanwhie youngsters in Finnland can apply for credit by sending a text message and also in Sweden youngsters are spiralling into debt because of the same reason.

Peak credit has been reached. That final wave of consumer recklessness created the exact conditions required for its own destruction. The housing bubble orgy was the last hurrah. It is not coming back and there will be no bigger bubble to replace it. Consumers and banks have both been burnt, and now everything will change.

Tags

American protectionism ANC Andrew Feinstein Apartamento em Niteroi Argentina argentina Azul Belgian-strike belgium biodiesel bonds borderlinx BOVESPA bovespa Brazilian_economy brazilian_real_currency_rate Brazil weekly news carbon casa casa em Florianopolis Colinas do Mar COPE credit crisis deflation dollar entrepeneurs environment ethanol EU recession exchange external_debt flights florianopolis food Gafisa GDP Brazil German_productivity global recession inflation Inga innovation interest rate Brazil interest rate South Africa keatingeconomics Latin America leisuretime Mbeki movie mozambique music national credit act Oceanair oil opportunity petrobras planning prime productivity real Real recession SAR sequoia solar South Africa south africa South_African_Economy south_africa_real_estate_2009 stagflation stocks timetracking united_states US economy 2009 US recession US_economy V-shape recession venezuela oil southafrica Zuma

Recent Comments

- Judith on Venezuela and South Africa: Signing Major Energy Deal I think I allready have been informed ab ...

- LuckyLuke on Linkedin discussion on BRIC countries Do you know that there is diet plan base ...

- JakeBoummaNom on Linkedin discussion on BRIC countries Hi to all. Hope i'm wellcome here. ...

- Illulavop on Linkedin discussion on BRIC countries http://imgwebsearch.com/35357/img0/casin ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hi I'm going to buy a bike. Counld someo ...

- fieftRopHoife on Linkedin discussion on BRIC countries Hey I'm going to buy a bike. Counld some ...